Sports

Wall Street Strategists Warn of Potential Market Bubble Ahead

Concerns are mounting among financial strategists that current market conditions may be creating an unsustainable bubble on Wall Street. With falling interest rates, increasing participation from retail investors, and relaxed regulatory measures, experts warn of a potential market correction that could have significant repercussions for investors.

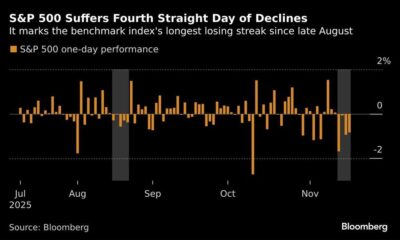

Several top strategists, including those from Goldman Sachs and Morgan Stanley, have voiced their apprehensions regarding the current state of the market. They highlight that the S&P 500 index has surged by approximately 20% since the beginning of 2023, driven largely by optimistic consumer spending and a favorable interest rate environment.

The Federal Reserve has played a pivotal role in this upward trend by reducing interest rates to stimulate economic growth. As borrowing costs remain low, companies have found it easier to finance operations and expand, leading to increased stock valuations. However, this situation raises questions about sustainability.

Retail Investor Influence

The influx of retail investors has also contributed to the market’s buoyancy. Since the onset of the COVID-19 pandemic, more individuals have entered the stock market, drawn by the potential for high returns. This growing participation has led to more volatile trading patterns, with retail investors often reacting to market trends driven by social media and online platforms.

According to analysts, while this trend can inject vitality into the market, it may also heighten the risk of a rapid downturn. The phenomenon known as “euphoria” can lead to inflated stock prices, leaving investors vulnerable when reality sets in.

Analysts argue that the current euphoria resembles market behavior seen prior to historical corrections. The dot-com bubble in the late 1990s and the financial crisis of 2008 serve as cautionary tales of how exuberance can swiftly turn into panic when investor sentiment shifts.

Regulatory Environment and Future Outlook

Another factor contributing to the potential bubble is the evolving regulatory environment. Financial regulations have been loosened in recent years, allowing for more aggressive trading strategies and increased leverage among investors. While this can facilitate growth and innovation, it also poses risks, particularly if market conditions change unexpectedly.

As strategists look ahead to 2024, they urge caution. They recommend that investors remain vigilant and consider diversifying their portfolios to mitigate risks associated with a potential market correction.

Despite the current optimism, experts emphasize the need for a balanced approach. With interest rates likely to remain low in the near term, continued growth may be possible. However, the underlying risks associated with inflated valuations and investor sentiment cannot be overlooked.

In summary, while the current market conditions may seem favorable, the potential for a significant correction looms large. As Wall Street navigates this complex landscape, both institutional and retail investors must remain alert to the signs of a bubble that could soon burst.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025