Technology

Global Stock Rally Continues as AI Partnerships Fuel Optimism

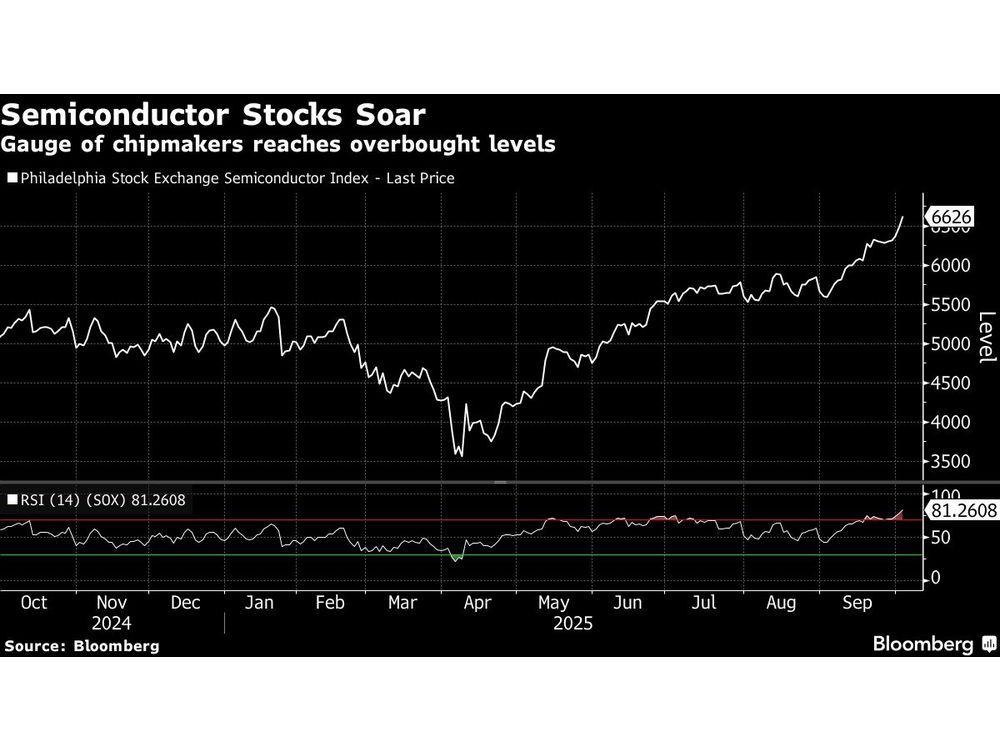

A surge in global stock markets persisted as optimism around artificial intelligence (AI) partnerships intensified. Asian technology stocks took the lead, reaching a new record, following announcements from major companies. Japan’s Hitachi Ltd. announced a collaboration with OpenAI focused on energy and infrastructure, while Fujitsu Ltd. expanded its partnership with Nvidia Corp.. This momentum set the stage for a potential sixth consecutive gain for the S&P 500, marking its longest winning streak since July.

European markets also experienced gains, with the Stoxx 600 index extending its record run, largely driven by rising mining shares. Copper prices were on track for their most significant weekly increase since April, reflecting strong investor demand. The ongoing influx of investments into the AI sector has led many to believe that these developments will translate into substantial profits for technology companies.

Market participants are increasingly confident, despite concerns regarding the Trump administration‘s announcement of potential cuts to federal jobs amid a government shutdown. Wolf von Rotberg, equity strategist at Bank J. Safra Sarasin, noted, “Markets remain as upbeat as they have been over recent days. Tech continues to push ahead, propelled higher by AI euphoria, while other sectors have been catching up lately.”

The Japanese yen weakened against the US dollar, influenced by comments from Kazuo Ueda, Governor of the Bank of Japan. Ueda maintained a cautious approach regarding interest rates, without signaling any immediate changes. Speculation about a rate hike had been growing, especially after two board members expressed dissent regarding the bank’s decision to keep current policies unchanged.

In commodities, gold prices were set for a seventh consecutive weekly rise, while oil was poised for its largest weekly decline since late June. This shift comes ahead of an upcoming OPEC+ meeting, which is expected to discuss the reintroduction of previously idled oil barrels.

Treasury markets also experienced movement, with the yield on 10-year Treasuries increasing by one basis point to 4.10%. Comments from Treasury Secretary Scott Bessent suggested a “pretty big breakthrough” could occur in upcoming trade discussions with China, particularly as the administration seeks to support US farmers affected by a decline in Chinese purchases.

Corporate developments further shaped market dynamics. Applied Materials Inc., the largest US manufacturer of semiconductor machinery, indicated that expanded export restrictions to China would impact its revenue. Additionally, Asahi Group Holdings Ltd. suspended some beverage shipments following a cyberattack that disrupted its operations in Japan.

In the tech sector, Boeing Co. announced that its 777X aircraft is now projected to have its commercial debut in early 2027, a delay from the previously anticipated launch next year. Meanwhile, Oracle Corp. is investigating security breaches affecting numerous clients’ E-Business Suite applications after an extortion campaign targeted large organizations.

As markets continue to react to these developments, key indicators show resilience. The Stoxx Europe 600 index rose by 0.4% in early trading, while US futures also pointed to higher openings. The outlook remains cautiously optimistic as investors monitor ongoing developments in both technology and economic policy.

Overall, the interplay between AI advancements, corporate strategies, and government policies will likely shape market trajectories in the coming weeks.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025