Technology

Lithium Market Shifts Focus to Storage Demand Amid Price Gains

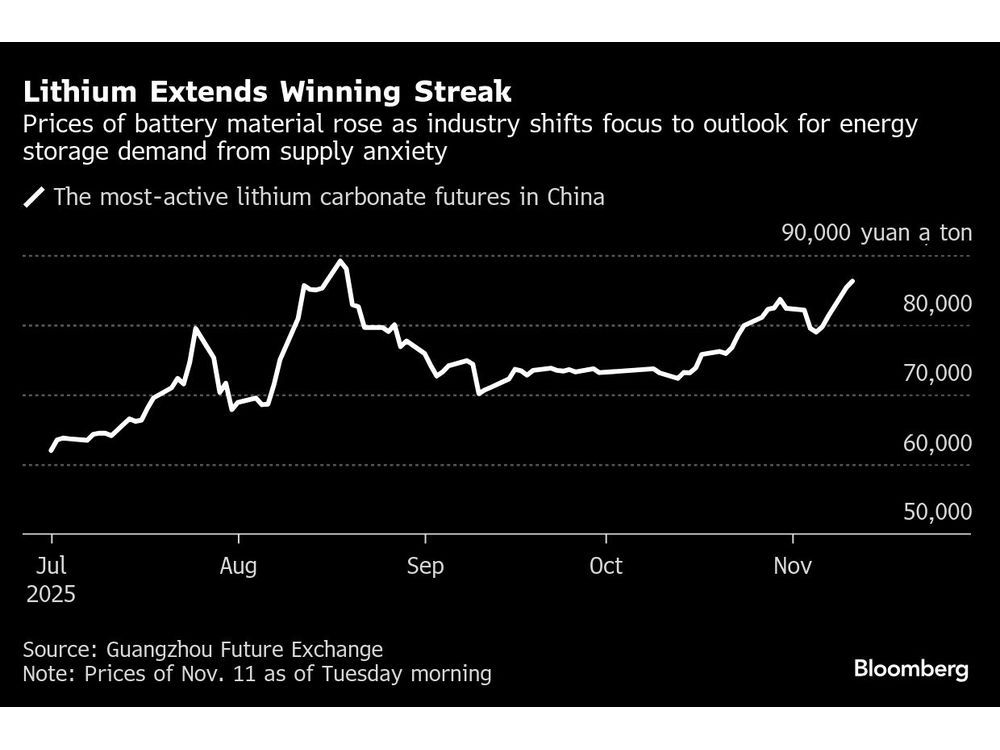

The lithium industry is experiencing a notable shift in focus from supply concerns to the burgeoning demand for large-scale battery storage. After a recent surge, the most-active futures for lithium carbonate, a key component in battery production, gained further momentum in Guangzhou, increasing by 5% on November 8, 2023. This uptick follows a series of fluctuations in spot prices, which, while currently at levels last observed in late August, remain over 85% below the peak recorded in 2022.

According to analysts at Citigroup Inc., the current momentum in the lithium market is primarily driven by strong demand rather than fears of supply disruptions. In a note dated November 9, they stated, “We think recent lithium momentum is driven by robust demand instead of potential supply disruption.” The analysts express growing confidence that demand for batteries will remain strong in the coming years.

A significant factor influencing this demand is the increasing reliance on energy storage systems (ESS). Su Jinyi, an analyst at Sublime China Information Co., noted that top-tier producers of lithium iron phosphate, or LFP, cathode materials are operating at full capacity due to the rising demand for energy storage. Jinyi explained, “Looking forward, the strong ESS performance could support carbonate demand, but industry players still need to monitor how its strength and sustainability will actually be reflected in the lithium market.”

The evolving landscape of the lithium market comes after a period of turmoil caused by the suspension of a mine operated by the world’s largest electric vehicle (EV) battery manufacturer, Contemporary Amperex Technology Co. Ltd. (CATL). Regulatory decisions regarding the mining rights for the Jianxiawo project have drawn significant attention, but the focus is now shifting toward the potential for strong demand in battery production.

Policy incentives, improving economic conditions, and expansion plans for energy storage systems contribute to the growing confidence in this sector. Citigroup projects that ESS will account for approximately one-third of total battery demand by 2030, an increase from around 20% in the previous year. The analysts emphasized that while historical indicators for ESS demand are limited, the current investment trends suggest a positive outlook.

Looking ahead, battery demand is expected to rise by 31% year-on-year by 2026. Within this growth, demand for energy storage systems and electric vehicles is anticipated to surge by 45% and 26%, respectively. Nevertheless, some analysts caution that the rapid escalation in lithium prices could lead to a potential correction. Zhang Weixin from China Futures Co. remarked, “The current price surge has been too rapid, and there’s a risk of pullback if the sentiment reverses.” Although the market logic currently centers around stronger demand projections for 2026, there are concerns that a shortage of lithium may not materialize in the near term.

The lithium market continues to evolve, with the focus now firmly on the potential of energy storage systems as a key driver of demand. As industry players navigate these changes, the implications for production and pricing will remain critical as they adapt to shifting market dynamics.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Politics4 days ago

Politics4 days agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Top Stories3 weeks ago

Top Stories3 weeks agoFamily Remembers Beverley Rowbotham 25 Years After Murder