Top Stories

Asset Managers Go All-In on Stocks, Defying Bubble Fears

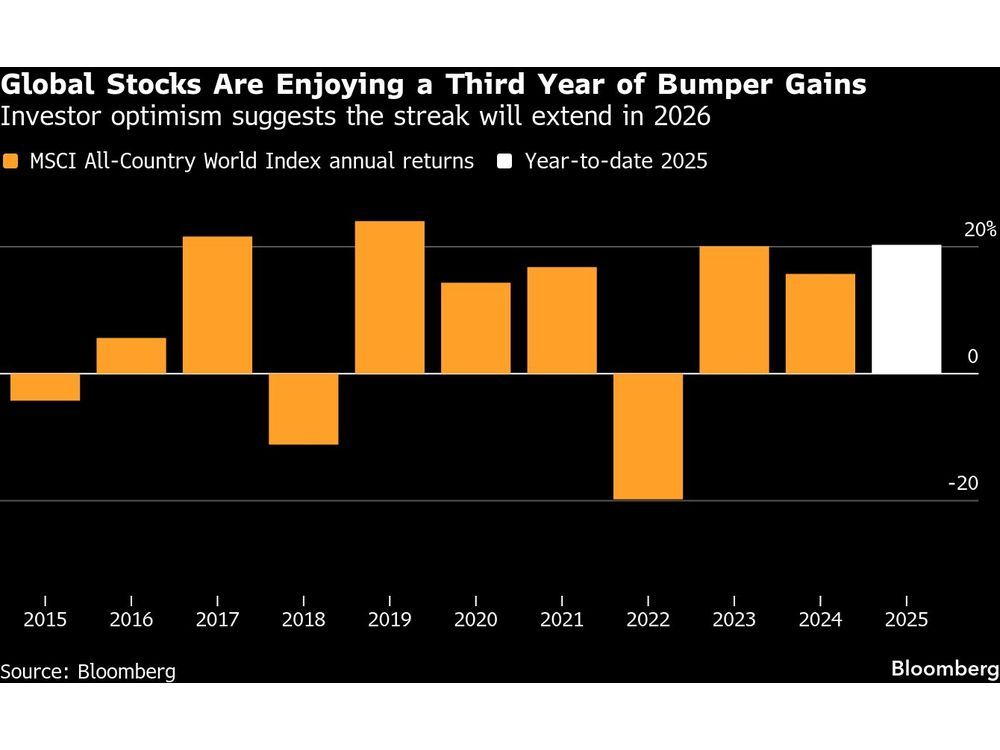

UPDATE: Despite widespread concerns about a potential market bubble, global asset managers are doubling down on stocks, revealing a strong “risk-on” sentiment. This follows a remarkable three-year streak of double-digit gains in equities, with experts predicting further bullish trends through 2026.

In a series of recent interviews conducted by Bloomberg News with 39 investment managers from top firms—including JPMorgan Asset Management, DWS Group, and Goldman Sachs—the consensus is clear: now is not the time to cash out. Sylvia Sheng, global multi-asset strategist at JPMorgan, stated, “Our expectation of solid growth and easier monetary and fiscal policies supports a risk-on tilt.”

This bullish outlook is underpinned by expectations of resilient global economic growth, advancements in artificial intelligence, and continued support from monetary policy and fiscal stimulus. Over 75% of asset allocators are positioning for a risk-on environment, signaling confidence in the ongoing market rally that has added a staggering $42 trillion in market capitalization since the end of 2022.

Investment managers, including Nannette Hechler-Fayd’herbe of Lombard Odier, advocate for “sufficient exposure, even over-exposure to equities,” particularly in emerging markets, where growth potential is deemed strong. Meanwhile, David Bianco, Americas chief investment officer at DWS, affirmed, “We are playing the powerful trends in place and are bullish through the end of next year.”

While concerns about a potential bubble loom, most managers maintain that the valuations of tech giants—often referred to as the “Magnificent Seven”—are not excessively high. Anwiti Bahuguna, global co-chief investment officer at Northern Trust Asset Management, emphasized, “You can’t call it a bubble when you’re seeing tech companies deliver a massive earnings beat.”

Investors are particularly optimistic about the U.S. market, which they believe will remain the engine of this rally. Jose Rasco of HSBC Americas stated, “American exceptionalism is far from dead.” Nevertheless, there is a call for diversification, with some analysts suggesting that opportunities in international markets, particularly in India, may yield significant returns.

The Russell 2000 Index, which tracks smaller U.S. companies, recently reached a record high, reflecting the optimism surrounding small-cap stocks. Stephen Dover, chief market strategist at Franklin Templeton, noted that small-cap stocks and industrials are expected to benefit from lowering interest rates and improved profitability.

However, caution remains prevalent. As inflation concerns resurface, managers warn that a sudden increase in prices could disrupt market momentum. Amélie Derambure, senior multi-asset portfolio manager at Amundi, expressed worry that inflation rebounding in 2026 could have dire implications for multi-asset funds, impacting both stocks and bonds.

Additionally, geopolitical uncertainties, particularly involving trade policies, continue to pose risks to investors. Scott Wren from Wells Fargo Investment Institute pointed out that geopolitical events affecting oil prices could significantly impact financial markets.

As asset managers navigate these complexities, many are leaning towards optimism, believing that the current bullish sentiment is justified. With major players like Goldman Sachs highlighting the potential for India as a growth market, and the overall market showing resilience, the next few years could be pivotal for investors.

Investors are urged to stay tuned as these developments unfold, with implications reaching beyond borders into global markets.

-

Politics3 months ago

Politics3 months agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World7 months ago

World7 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Top Stories1 month ago

Top Stories1 month agoUrgent Fire Erupts at Salvation Army on Christmas Evening

-

Sports1 month ago

Sports1 month agoCanadian Curler E.J. Harnden Announces Retirement from Competition

-

Lifestyle5 months ago

Lifestyle5 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoFatal Crash on Highway 11 Claims Three Lives, Major Closure Ongoing

-

Entertainment7 months ago

Entertainment7 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science7 months ago

Science7 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle7 months ago

Lifestyle7 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology5 months ago

Technology5 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoBlue Jays Sign Kazuma Okamoto: Impact on Bo Bichette’s Future

-

Top Stories2 months ago

Top Stories2 months agoNHL Teams Inquire About Marc-André Fleury’s Potential Return