Top Stories

Australia Urged to Reform Energy Market for Clean Investment NOW

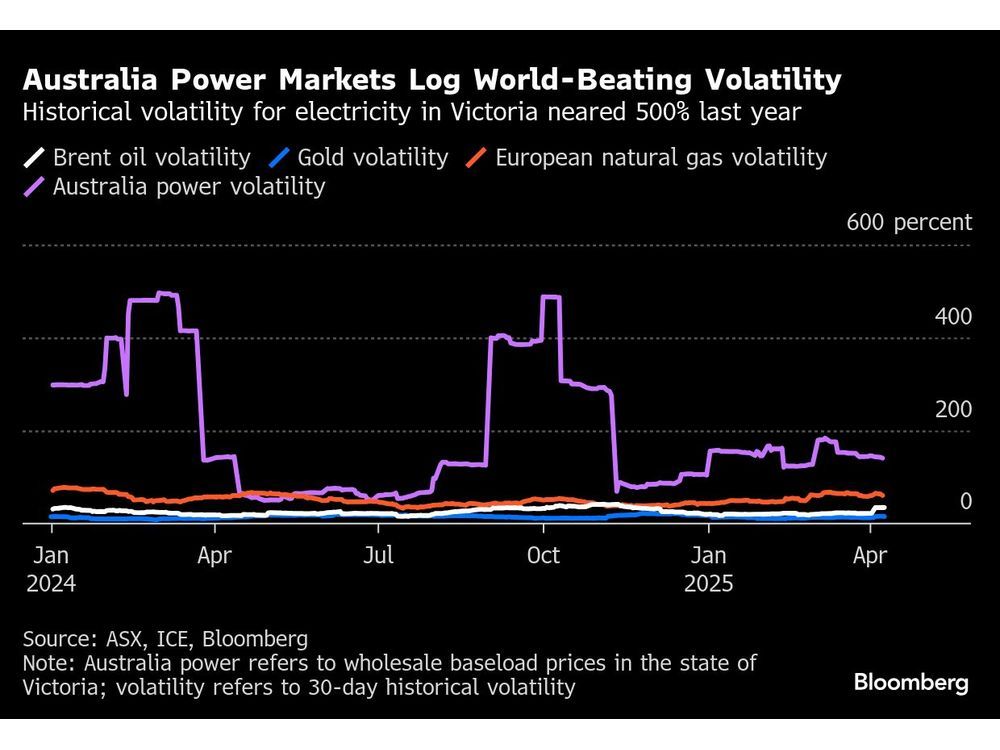

URGENT UPDATE: A panel of independent experts has just announced critical recommendations for sweeping reforms to Australia’s electricity market, aimed at spurring long-term investment in clean energy. As grid volatility escalates, the proposed changes are essential to meet Australia’s ambitious 2030 target of doubling renewable generation.

The draft review of the National Electricity Market (NEM) emphasizes the need for a new framework that offers long-term derivative contracts. This would facilitate investment in stable and dispatchable renewable energy sources and storage projects. Currently, persistent barriers are stalling new initiatives, as the mismatch between the long-term financing needs of energy projects and the short-term contracting horizons of buyers creates uncertainty.

Tim Nelson, Chair of the NEM Review, stated, “If we get the right market settings in place, we can deliver a secure, affordable, low-emissions electricity system.” The report highlights the urgent nature of these reforms, warning that without them, Australia risks falling behind in its clean energy transition.

New investment opportunities are being jeopardized by ongoing uncertainty regarding power market mechanisms and policy settings. This not only threatens Australia’s potential to become a major green energy export hub but complicates efforts to stabilize and decarbonize the grid.

The draft report reveals that Australia’s flagship clean power investment program, recently expanded by 25%, has helped mitigate some risks for investors. However, it cautions that new projects are unlikely to advance unless initiatives like the Capacity Investment Scheme (CIS) are fully integrated into the power markets.

In contrast, the proposed Electricity Services Entry Mechanism would operate within the market’s legal framework and focus support on the latter stages of project life, enhancing liquidity through contract recycling. Industry stakeholders have welcomed this review. The Clean Energy Council stressed the importance of enabling investors to secure long-term contracts, which are crucial for underpinning 25–30-year infrastructure investments.

The report also advocates for an “always-on mandatory market making obligation.” This would enhance hedging tools through price transparency, requiring large energy entities to continuously quote prices for key electricity derivatives. “These recommendations seek to solve the most material issue preventing efficient long-term investment and deliver the services consumers need,” the draft review asserts.

As the panel works towards a final report and implementation roadmap due by the end of 2025, experts urge immediate action. The urgency of these reforms cannot be overstated as Australia navigates its path toward a sustainable energy future.

This developing story highlights a crucial juncture for Australia’s energy landscape, with potential implications for both investors and consumers alike. Stay tuned for more updates as this situation unfolds.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025