Top Stories

Campbell River Business Owner Loses $82K to Urgent Phone Scam

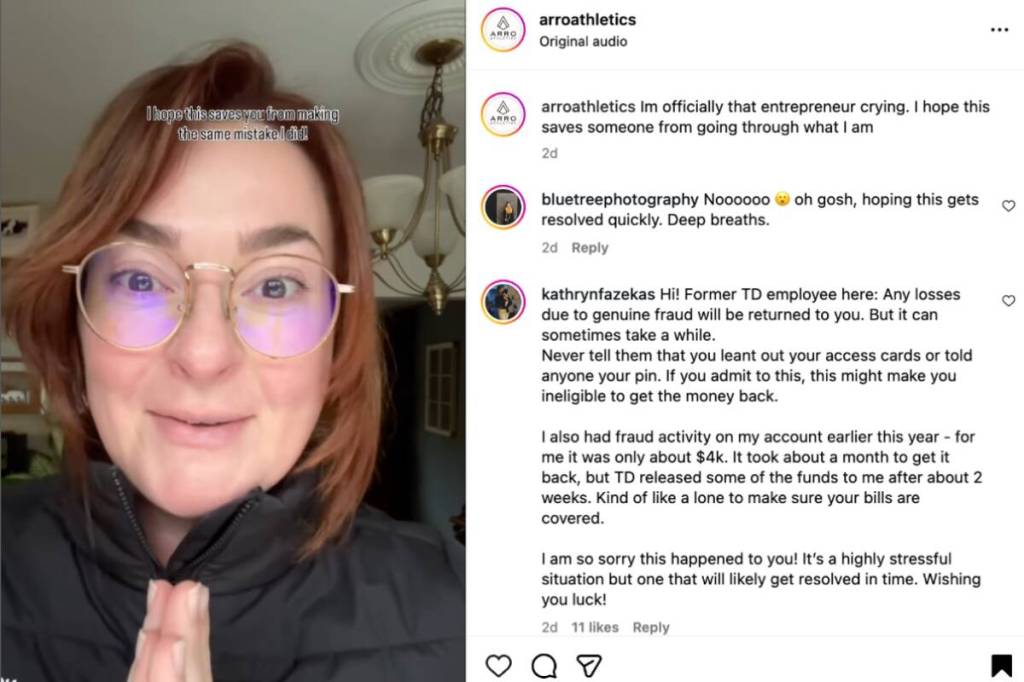

UPDATE: A devastating phone scam has cost a Campbell River business owner, Farro Mackenzie, a staggering $82,000. The owner of Arro Athletics fell victim to fraudsters posing as representatives from TD Bank, highlighting the urgent need for vigilance against such scams.

The troubling incident began when Mackenzie received a text message about unauthorized payment attempts on her credit card. Responding to inquiries about these charges, she unwittingly engaged with the scammers. “From there, somehow they’d gotten into my business chequing account and created a $53,000 payment to a company called Silver Gold and a $29,000 payment to a Scotia line of credit,” she revealed.

The fraud was only uncovered when the scammers attempted to withdraw an additional $20,000. “I was like, ‘That payment’s not me,’” Mackenzie recalled. “They were like, ‘Good, we caught it.’” Believing the issue was resolved, she later discovered her funds were gone while at a TD Bank branch to purchase inventory.

Mackenzie expressed confusion over how the scammers accessed her chequing account, stating she did not disclose any sensitive information. “They can hijack the phone number and caller ID,” she warned in a social media post. “This is my warning to you. Do not trust any calls. Do not answer those calls. Hang up and call yourself on the number on the back of your card.”

This type of fraud, known as spoofing, involves cybercriminals disguising their communications to appear legitimate. According to Get Cyber Safe, a Government of Canada resource, “Cyber criminals use spoofing to fool victims into giving up sensitive information or money or downloading malware.”

In response to this alarming situation, Mick Ramos, a senior manager at TD Bank, expressed regret over Mackenzie’s loss. “While we can’t speak to details of any particular case due to client privacy, I can confirm our team is looking into this matter and has reached out to Ms. Mackenzie,” he stated. He also advised individuals receiving suspicious calls to hang up and dial the number on the back of their debit cards, using a different phone line if possible.

Officials at the Canadian Anti-Fraud Centre report that as of September 30, 2025, there have been 33,854 reported cases of fraud this year, impacting 23,113 victims and resulting in a staggering loss of $544 million. Victims are urged to report scams immediately to their financial institutions, credit bureaus, local police, and the Canadian Anti-Fraud Centre.

Mackenzie’s experience serves as a critical reminder for all consumers to remain alert. The sophistication of these scams underscores the importance of verifying any communications claiming to be from banks or financial institutions. As fraudsters become increasingly adept at exploiting technology, it is imperative to prioritize personal and financial security.

Stay tuned for further updates on this developing story and consider sharing this warning to help others avoid similar scams.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment4 months ago

Entertainment4 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Top Stories1 week ago

Top Stories1 week agoFamily Remembers Beverley Rowbotham 25 Years After Murder