Top Stories

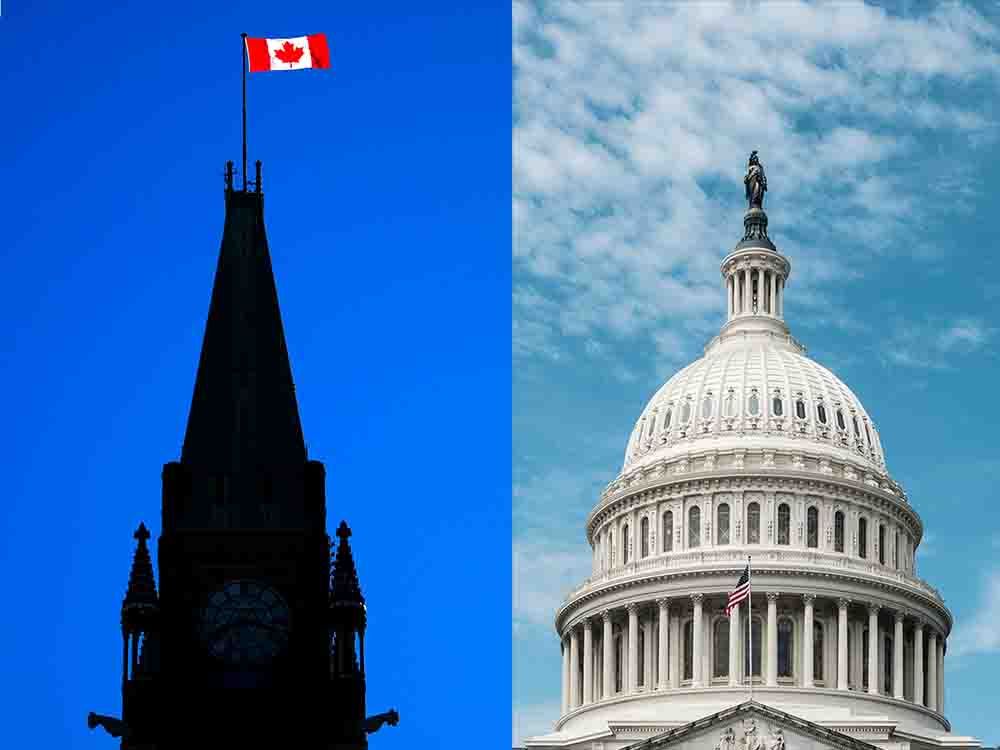

Canada and U.S. Face Fiscal Crisis: Who’s the Bigger Budget ‘Basket Case’?

UPDATE: In a striking new analysis, economists at the National Bank of Canada reveal that Canada’s fiscal situation may not be as rosy as many believe, challenging the long-held perception that the United States is the primary budget “basket case.” With a staggering fiscal deficit of US$1.6 trillion, the U.S. has often been criticized for its budgetary management, but recent evaluations suggest Canada is not far behind.

URGENT DEVELOPMENTS: Economists Warren Lovely and Taylor Schleich emphasize that Canadian governments—both federal and provincial—are currently tapping debt-capital markets just as aggressively as the U.S., raising alarm bells about the country’s fiscal health. “Believe it or not, Canadian governments are currently engaging in a borrowing spree that mirrors the fiscal behavior of ‘Uncle Sam,’” they stated in a recent note.

In a significant period from April to August 2023, Canada’s combined federal and provincial governments issued approximately $220 billion in gross bonds—an increase of 44% from the previous year. Alarmingly, this amount represents 1.4% of Canada’s gross domestic product (GDP) per month. In contrast, the U.S. saw gross Treasury issuance near US$2 trillion, which, while substantial, translates to a slightly restrained 1.3% of GDP monthly.

IMMEDIATE IMPACT: These figures raise critical questions about Canada’s fiscal sustainability, especially as the federal government prepares for further borrowing ahead of a delayed budget release scheduled for this fall. “With abundant bond supply and a rising debt burden, Ottawa appears set on a concerning course,” Lovely and Schleich added, highlighting a paradoxical approach of “austerity and investment.”

The economists further clarified that Canada’s decentralized government model allows for more aggressive debt issuance by provincial governments, contrasting sharply with the more centralized U.S. system. In the first quarter of 2023, non-federal levels of government in Canada held $1.2 trillion in debt, while Ottawa’s share stood at $1.4 trillion. Conversely, total outstanding federal debt in the U.S. reached an astonishing US$28.5 trillion, with state and local debt at US$3.4 trillion.

WHAT TO WATCH FOR: As both nations grapple with their budgetary challenges, Canadian officials, including Prime Minister Mark Carney, are expected to announce significant infrastructure projects that could further impact financial stability. Meanwhile, President Donald Trump’s massive tax bill continues to create uncertainty for U.S. federal finances.

Despite Canada’s past claims of having one of the lowest national debt-to-GDP ratios among G7 nations, the economists warn against complacency. “Financial transparency and budgetary effectiveness remain paramount now and into the future,” they concluded, underscoring the urgency for both countries to address their fiscal realities.

This developing story is crucial for citizens and investors alike, as the implications of these budgetary strategies will resonate across both nations. Stay tuned for more updates on this critical economic landscape.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Top Stories1 week ago

Top Stories1 week agoHomemade Houseboat ‘Neverlanding’ Captivates Lake Huron Voyagers