Top Stories

China Seizes Opportunity as Russian Oil Exports to India Plunge

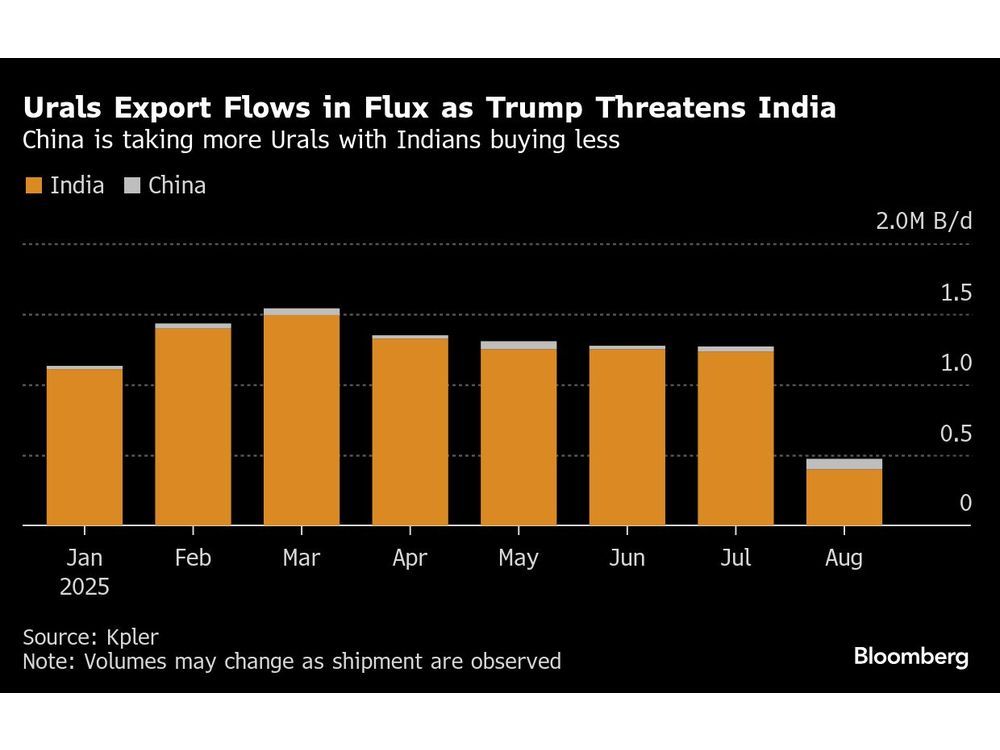

UPDATE: Chinese refiners are rapidly increasing their imports of Russian oil as India’s purchases collapse amidst escalating U.S. tariffs. Reports confirm that in August, China has nearly doubled its intake of Urals crude, reaching approximately 75,000 barrels per day, compared to the year-to-date average of about 40,000 barrels, according to shipping data from Kpler.

This surge comes as the U.S. government under President Donald Trump imposes new tariffs on Indian imports, seeking to penalize the country for its continued reliance on Russian crude. Exports to India have plummeted to just 400,000 barrels per day this month, significantly lower than the 1.18 million barrels average earlier in the year.

Analysts emphasize that Chinese refiners are in a favorable position to capitalize on discounted Russian oil. “Chinese refiners are actively taking advantage of this situation, unlike their Indian counterparts,” stated Jianan Sun, an analyst at Energy Aspects Ltd. The Urals crude, which ships primarily from Russia’s west, remains competitive against alternatives from the Middle East.

As the global oil market watches these shifts closely, the implications are significant. The U.S. is intensifying its diplomatic efforts to resolve the ongoing conflict in Ukraine, which has a direct impact on energy flows. Last Friday, Trump indicated he would delay increasing tariffs on Chinese goods, citing positive discussions with Russian President Vladimir Putin regarding the war.

In contrast, Trump has labeled India’s purchasing of Russian oil as “opportunistic and deeply corrosive.” However, experts suggest the U.S. may struggle to exert similar pressure on China without facing negative repercussions domestically. “Trump knows he can’t push too hard on China without hurting U.S. interests,” explained Mukesh Sahdev, head of commodity markets at Rystad Energy A/S.

So far, Chinese refiners have reportedly secured between 10 to 15 cargoes of Urals for delivery in October and November, a notable increase in their usual volume. “If prices remain attractive, we anticipate even more November deliveries,” noted Muyu Xu, a senior crude analyst at Kpler. The Urals crude is currently priced at a $1 premium over Dated Brent, indicating robust interest from Chinese buyers.

Currently, at least two tankers, the Georgy Maslov and Zenith, each capable of carrying 1 million barrels, are awaiting off the coast of Zhoushan, a strategic hub for Zhejiang Petroleum & Chemical Co. This location is crucial for China’s energy storage and distribution networks.

Indian refiners, however, are on the sidelines, considering offers for Urals but not actively purchasing. The excess supply of Russian oil necessitates removal, and analysts believe that only China can effectively absorb this surplus. “Without Chinese purchases, Russian crude may need to offer even deeper discounts to attract new buyers,” Sahdev warned.

As the situation develops, all eyes remain on the evolving dynamics of the global oil market and the geopolitical implications of these trade shifts. The ongoing conflict and its economic reverberations will continue to shape the energy landscape in the coming weeks.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025