Top Stories

Chinese EV Companies Invest $16 Billion Abroad, Surpassing Domestic Spending

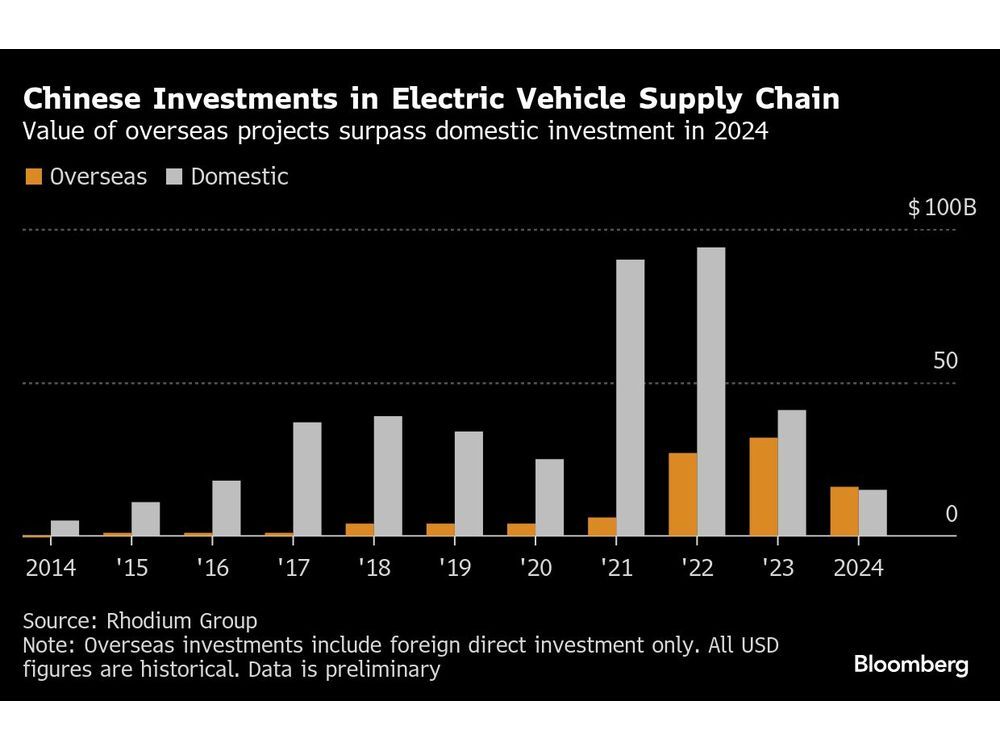

BREAKING: Chinese electric vehicle (EV) companies have made a historic move by investing more abroad than at home for the first time in 2024. In a stunning shift, firms along the supply chain allocated approximately $16 billion to foreign projects, just ahead of the $15 billion spent domestically, according to the latest report from Rhodium Group.

This development reflects a significant change in strategy as companies face intense competition and price wars in China’s saturated market. As Armand Meyer, senior research analyst at Rhodium, stated, “The fact that overseas investments now outpace domestic ones reflects a saturated Chinese market and the strategic appeal of expanding abroad for higher returns.”

The majority of these investments are directed towards battery production, with around three-quarters coming from prominent battery manufacturers. Major players like Contemporary Amperex Technology Co. Ltd. (CATL), Envision Group, and Gotion High-Tech Co. are expanding operations globally in response to high transport costs and demands for localized supply from clients such as Tesla Inc. and BMW AG.

In June, CATL identified international expansion as its top priority, driven by fierce competition within China’s automotive sector. Meanwhile, BYD Co., China’s leading automaker, has already established factories in Brazil and Thailand, with plans to build facilities in Turkey and Indonesia. Chery Automobile Co. is also venturing into international markets, pledging a $1 billion investment in an EV factory in Turkey.

Despite the allure of overseas expansion, the report highlights that international projects often come with increased costs, longer construction times, and greater regulatory risks. Only 25% of EV manufacturing initiatives announced abroad have been completed, compared to a 45% completion rate domestically. Notably, BYD recently postponed plans for a major plant in Mexico due to geopolitical tensions and uncertainties related to U.S. trade policies.

Domestic projects benefit from quicker initiation; battery factories in China typically begin construction within 3 to 12 months, while foreign projects may take 10 to 24 months to get underway. The report also notes that Svolt Energy Technology Co., a battery maker from northern China, canceled 99% of its previously announced overseas investments.

The international push by Chinese EV companies must navigate various challenges, including uneven global demand for electric vehicles and regulatory pushback in markets like the EU. Additionally, firms must be cautious of Beijing’s growing concerns over technology transfer and potential job losses, which could lead to stricter outbound investment controls.

As the landscape of the global EV market evolves, all eyes will be on how these Chinese companies adapt to the new realities of international investment and competition. The urgency of this situation cannot be overstated—stay tuned for further updates as more developments emerge.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025