Top Stories

Chinese Solar Stocks Surge 5.9% Amid Industry Recovery Signals

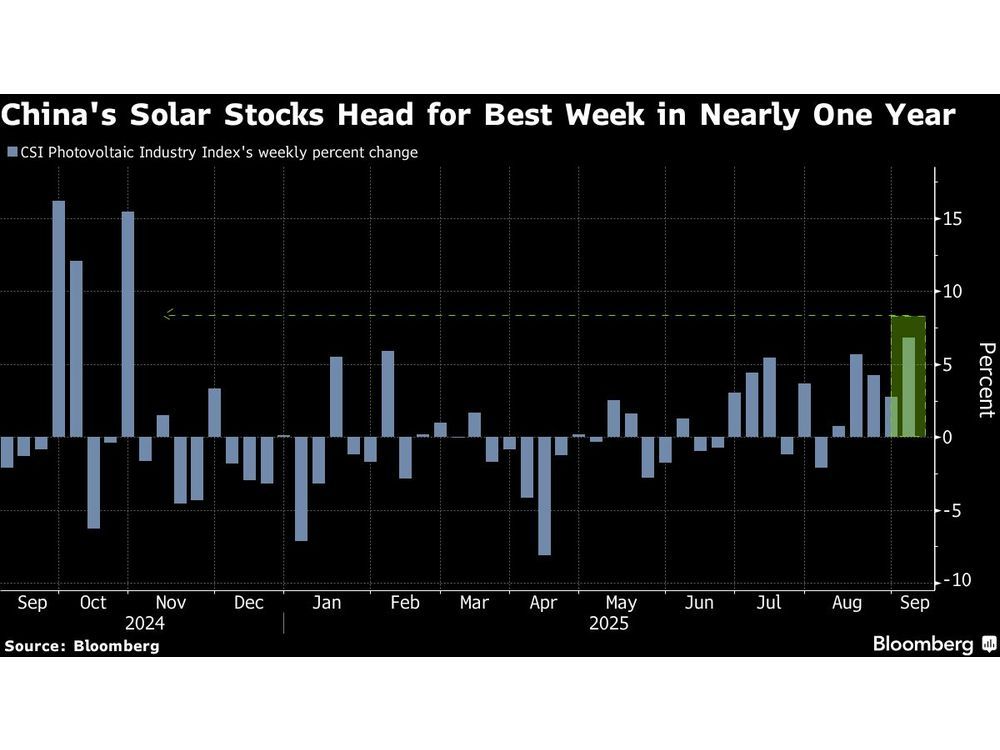

UPDATE: Chinese solar stocks are experiencing a significant surge, with the CSI Photovoltaic Industry Index soaring by 5.9% on Friday, marking the index’s best week since October 2022. This bullish momentum signals a potential recovery in the solar sector as authorities intensify efforts to tackle overcapacity and end fierce price wars.

The latest rally follows a rebound that began in early August, fueled by signs that Beijing’s anti-involution campaign is successfully combating deflation and igniting a price recovery within the industry. Among the standout performers, both Sungrow Power Supply Co. and CSI Solar Co. have seen their shares rise by a remarkable 10% or more.

Recent data from the China Silicon Industry Association indicates that wafer prices in China have continued their upward trend, registering gains between 0.7% and 2.4% this week. The association noted, “Overseas demand remains strong, and foreign buyers have relatively high tolerance for wafer price increases,” reinforcing the positive outlook for the sector.

Industry leaders are echoing this optimism. Daqo New Energy Corp., a major player in the polysilicon market, declared that the industry is at a clear turning point. Meanwhile, Longi Green Energy Technology Co. emphasized that China’s solar sector can effectively address its overcapacity challenges by embracing technological advancements and enhancing quality standards.

In addition to solar stocks, the battery sector is also on the rise. Eve Energy Co. has seen its shares skyrocket by 25% this week, becoming one of the top performers in the MSCI Asia Pacific Index. This surge is attributed to robust demand for energy storage solutions, further bolstering investor confidence in renewable energy markets.

As the solar industry shows signs of recovery, market participants are closely monitoring upcoming announcements and developments that could influence future growth. Analysts remain optimistic, citing the need for continuous innovation and strategic investments in technology to maintain momentum.

Investors and stakeholders in the renewable energy sector should stay tuned for further updates as this situation evolves, with implications that could resonate globally. The recovery of Chinese solar stocks not only affects local markets but also has potential impacts on international supply chains and energy policy.

This is a developing story, and more updates are expected as the situation continues to unfold.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025