Top Stories

Dongfeng Motor Shares Surge 69% on Major EV Restructuring Plans

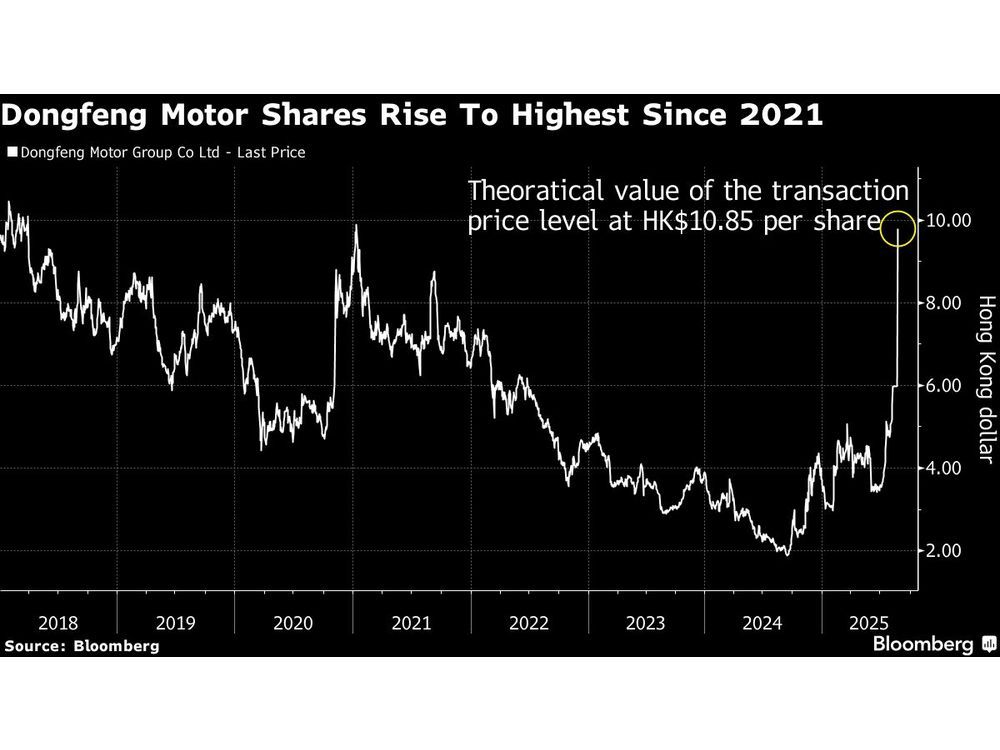

URGENT UPDATE: Shares of Dongfeng Motor Group soared by an astonishing 69% today, marking the largest jump in six months, following the company’s announcement of a transformative restructuring plan focused on the booming electric vehicle (EV) market. The stock surged to HK$10.10 as trading resumed after a two-week suspension, signaling investor optimism about the company’s future.

This significant move comes as Dongfeng plans to withdraw its shares from the Hong Kong exchange and create a new listing for its Voyah brand, which specializes in luxury new-energy vehicles. The overhaul is projected to value the company at approximately HK$10.85 per share, according to company sources.

The restructuring follows a directive from China’s State Council in March, encouraging consolidation among state-owned automakers to enhance competitiveness. Dongfeng, along with Chongqing Changan Automobile Co. and China FAW Group, have struggled to keep pace with domestic rivals like BYD Co., as consumer preferences shift away from traditional foreign brands.

In the first seven months of 2023, Dongfeng’s joint ventures with Honda Motor Co. and Nissan Motor Co. accounted for half of its vehicle sales. Analysts at JPMorgan Chase & Co. highlighted that this proposed transaction aims to “unlock the hidden value of the company,” noting that Dongfeng has been trading at a significant discount to its book value.

Since its launch in 2020, the Voyah brand has rapidly gained traction, with sales skyrocketing by 86% to 66,680 units this year. The brand’s projected sales could reach 150,000 vehicles in 2023 and climb to 260,000 by 2024, according to estimates from Citigroup Inc.

The restructuring not only aims to refocus the company but also involves the sale of Dongfeng’s 50% stake in a Guangzhou-based joint venture with Honda, valued at around 5.4 billion yuan ($740 million). This strategic move is expected to further enhance Dongfeng’s position in the competitive EV landscape.

The announcement concludes months of speculation regarding Dongfeng’s strategic direction. Earlier this year, reports indicated potential merger talks between Dongfeng and Changan, but a new government entity became the controlling shareholder of Changan in July, consolidating the influence of Beijing over key automotive players.

As Dongfeng pivots towards a more electric future, the automotive industry watches closely. The implications of this restructuring could have ripple effects across the sector, impacting everything from supply chains to consumer choices. Investors and analysts alike are eager to see how these changes will unfold in the coming months.

Stay tuned for more updates on this developing story as Dongfeng Motor Group charts a new course in the electric vehicle market.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025