Top Stories

Economists Confirm Brexit Costs £200 Billion, Warning Grows Urgent

URGENT UPDATE: New reports reveal that the economic fallout from Brexit is far worse than previously believed, with estimates soaring to a staggering £200 billion ($267 billion). Economists from the National Bureau of Economic Research (NBER) confirm that the long-term impact on the UK’s GDP could be as high as 8%, a significant increase from earlier predictions.

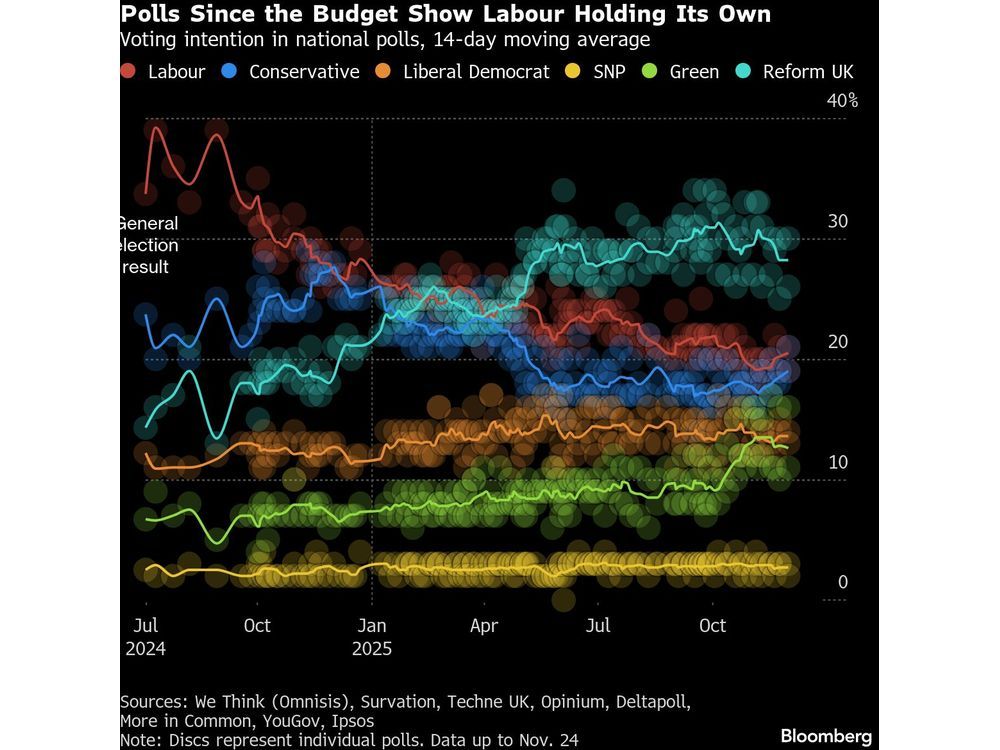

In a shocking turn of events, the Labour Party is now confronting the harsh economic realities of Brexit, fueled by a bold strategy to counter the growing influence of Nigel Farage‘s Reform party. Prime Minister Keir Starmer stated, “We must confront the reality that the botched Brexit deal significantly hurt our economy,” signaling a critical shift in political tone.

Recent findings highlight that the UK’s official forecasters may have underestimated the economic damage from Brexit by as much as half. A new paper authored by economists including Nicholas Bloom and Paul Mizen suggests that the predicted 4% reduction to the UK’s long-term GDP was far too optimistic. The economic landscape continues to shift as the Labour Party prepares for upcoming elections, now advocating for closer ties with the European Union.

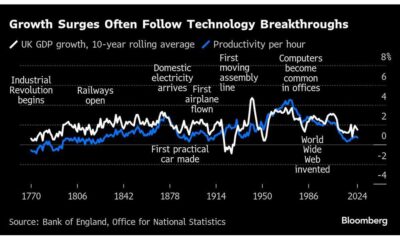

The Centre for European Reform further supports these claims, arguing that without Brexit, the UK could have experienced growth rates comparable to the US rather than trailing behind France and Germany. Economists assert that Brexit has been a series of continuous shocks rather than a one-time event, leading to prolonged uncertainty that has stifled business investment and economic innovation.

The government’s ambivalent stance towards the EU is under scrutiny, especially as Labour faces pressure from both the left and center. The Liberal Democrats are pushing for a vote on negotiating a new customs union, citing the NBER research that underscores the negative economic impacts of Brexit.

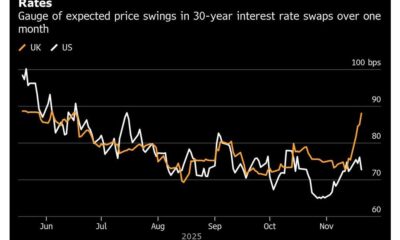

According to Mizen, uncertainty surrounding Brexit has hindered not only investment but also hiring, as companies diverted resources to prepare for new trade rules instead of focusing on growth. The NBER study’s counter-factual model indicates that Brexit has effectively caused a 6% decline in GDP, with small and medium-sized businesses facing significant challenges.

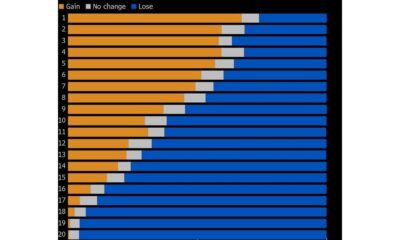

The implications are dire: while larger firms may still engage in trade with the EU, they do so at higher costs. The study reveals a 30% plunge in exports from the smallest UK businesses, leading to an overall 6.4% reduction in UK exports worldwide.

As the political landscape evolves, the Labour Party’s newfound willingness to address these issues could reshape their electoral strategy. With Rachel Reeves, the Chancellor, openly attributing low productivity to Brexit, the urgency for a clear policy direction is palpable.

Economists warn that the true effects of Brexit may take years to fully materialize, with potential long-term consequences for the UK economy. The evidence is mounting that the damage is not just a temporary setback but a profound shift that could redefine the UK’s economic future.

As this story develops, all eyes will be on the Labour Party’s strategy and the government’s response to the growing concerns over Brexit’s long-term impact. The public and businesses alike are eager for clarity and a path forward in these uncertain economic times.

-

Politics1 month ago

Politics1 month agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Top Stories1 week ago

Top Stories1 week agoHomemade Houseboat ‘Neverlanding’ Captivates Lake Huron Voyagers

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit