Top Stories

Europe’s Diesel, Jet Fuel Imports Surge Amid Russia Sanctions

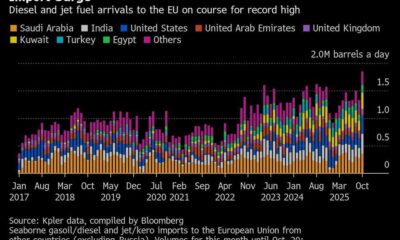

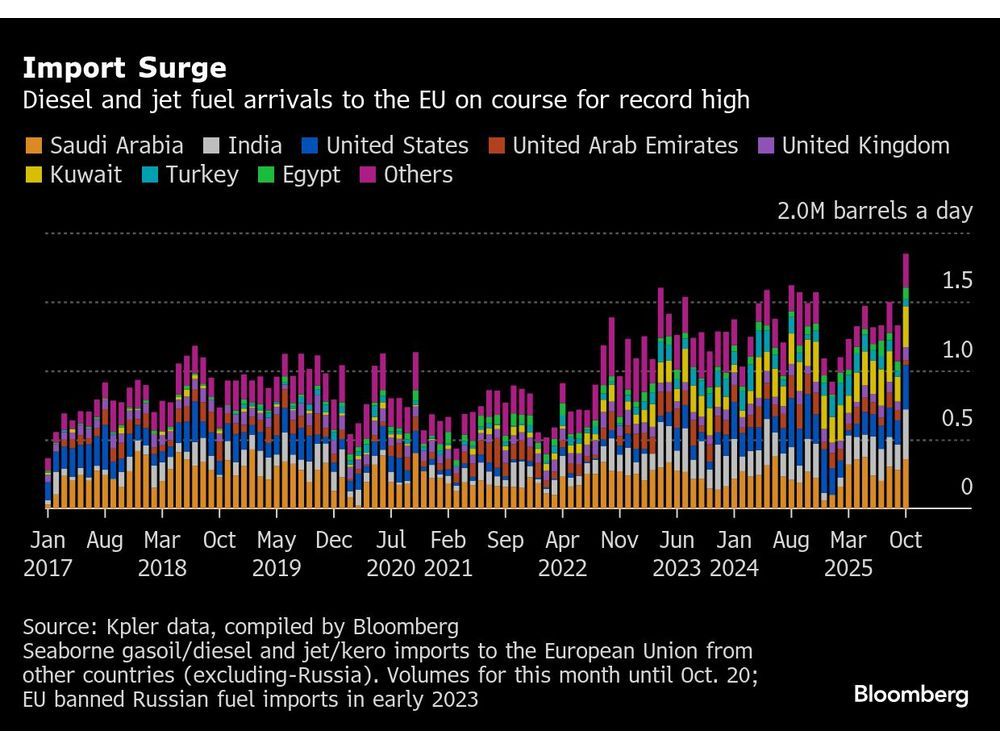

UPDATE: Europe is witnessing an unprecedented surge in diesel and jet fuel imports as traders expedite supplies ahead of looming sanctions on Russian petroleum products. Official data shows that between October 1-20, 2023, the region received almost 1.9 million barrels from nations including India, Saudi Arabia, and the United States. If this pace continues, Europe is set to achieve a record-breaking month for these crucial fuel imports.

The European Union has been grappling with energy supply challenges since it banned Russian supplies in early 2023. As winter approaches, demand for heating fuels is expected to rise, intensifying pressure on the EU’s energy supply chain. The impending restrictions on purchases from processors of Russian crude threaten to further destabilize trade flows, compelling Europe to seek alternative sources.

The US recently intensified pressure on global markets by blacklisting major Russian energy companies, Rosneft PJSC and Lukoil PJSC. This move complicates the supply chain, making it increasingly difficult for traders to secure Russian-linked fuel. Senior executives at Indian refineries, which have been significant purchasers of Russian crude, indicate that these sanctions will likely halt the flow of Russian oil to major processors.

With refinery closures—some permanent, some for repairs—exacerbating supply shortages in Europe, the urgency to import diesel and jet fuel has never been more critical. Traders are now racing to capitalize on favorable prices before new EU restrictions take effect on January 21, 2024. According to Eugene Lindell, head of refined products at consultancy FGE NexantECA, “When the arbitrage is open ahead of winter, you’re gonna take that opportunity and buy.”

The situation is further complicated by the anticipated impact of EU sanctions on trade patterns. Although the initial sanctions did not completely sever ties to Russian crude, the new regulations target a loophole that allowed some nations to continue trading. This could disrupt supplies significantly, especially since Russia was previously the EU’s largest diesel supplier.

India has emerged as a key player, supplying approximately 362,000 barrels per day, or 20% of the EU’s middle distillate imports during the first three weeks of October. If this trend persists, it would mark the highest monthly volume from India since records began in 2017.

As the global oil market braces for a “game of musical chairs,” Indian refiners are positioned to fill the gaps left by Russian barrels. However, uncertainty looms over whether China, another major buyer of Russian crude, will increase its purchases amid rising risks to its own petroleum industry and ongoing trade negotiations with the US.

Experts predict that while there will be a reduction in trade flows, complete cessation of Indian imports is unlikely. According to Fernando Ferreira, director of Rapidan Energy Group, “There will be a reduction or rearrangement of trade flows, but not a complete zeroing out of imports from India.”

As Europe faces a critical winter ahead, the dynamics of global energy trade are shifting rapidly. Traders and governments are on high alert, preparing for the implications of these sanctions and the evolving landscape of fuel supplies. The situation remains fluid, and developments are expected to unfold in the coming weeks, making it essential for stakeholders to stay informed.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 weeks ago

Top Stories2 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics2 weeks ago

Politics2 weeks agoShutdown Reflects Democratic Struggles Amid Economic Concerns