Top Stories

Fed Cuts Rates Amid Weak Job Growth and Steady Inflation

UPDATE: The Federal Reserve is set to cut interest rates next week following a shocking downward revision of 911,000 in US job growth. This significant adjustment, coupled with steady inflation figures, has heightened market expectations for a series of rate cuts by the US central bank.

Just announced, the latest data shows that US job growth was far weaker than previously reported, with payrolls reflecting a 0.6% decline in employment numbers. This stark revision adds pressure on the Federal Reserve to act decisively, as traders anticipate a shift in monetary policy. The Fed will likely respond to these economic signals when they meet next week.

The inflation landscape remains stable, with the US Consumer Price Index rising 0.3% in August, mirroring increases seen in new and used cars, apparel, and appliances. However, analysts remain divided on the impact of tariffs, with some focusing on surging costs in travel-related services like airfares and hotel stays.

In Europe, the European Central Bank (ECB) has decided to hold interest rates steady for the second consecutive meeting, signaling that they may pause further cuts. ECB officials emphasized a cautious, data-driven approach moving forward, leaving markets awaiting further guidance based on economic indicators.

Amid these developments, France faces a political crisis that threatens to undermine its economic stability, with the national growth forecast slashed to just 0.8% for 2025, trailing behind the euro area average of 1.4%. Following a government collapse earlier this week, Prime Minister Sebastien Lecornu is now contending with mass protests as he seeks parliamentary support for crucial budget cuts.

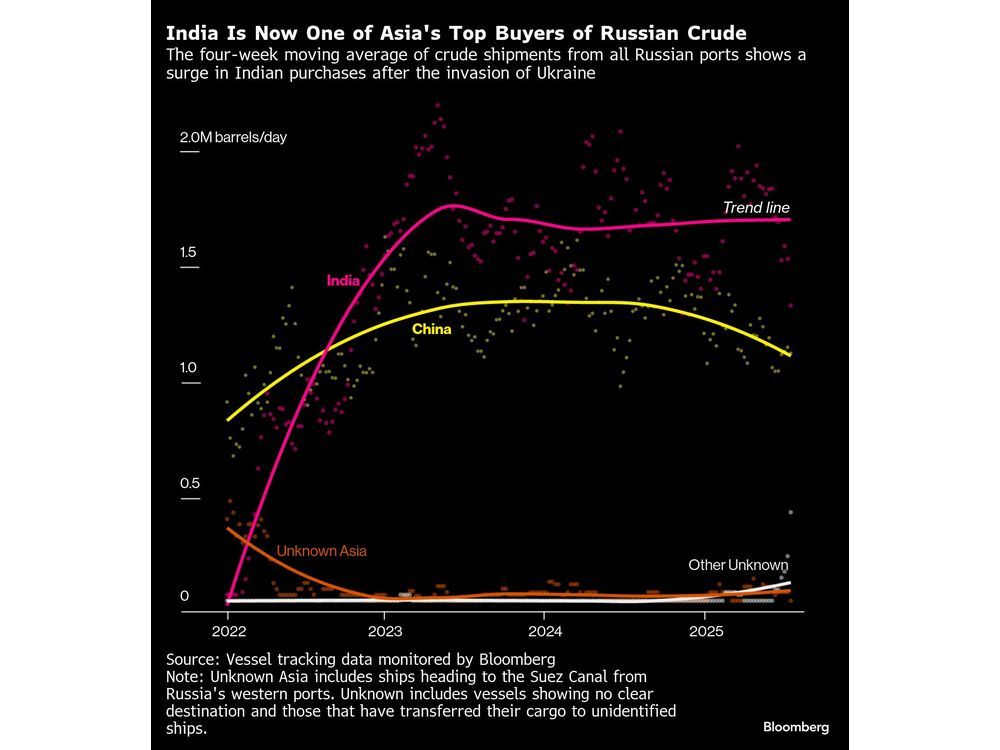

In Asia, China‘s export growth has slowed dramatically, marking its weakest performance in six months as shipments to the US decline. However, a surge in sales to other markets keeps the nation on track for a record trade surplus exceeding $1.2 trillion this year.

In emerging markets, Turkey has revised its economic growth expectations downward, prioritizing price stability over rapid expansion. Meanwhile, South Africa‘s economy has shown resilience, expanding at the fastest rate in two years, driven by a robust rebound in manufacturing and mining sectors.

The global economic landscape remains precarious, and as the US prepares for a pivotal interest rate decision, the implications of these developments will resonate worldwide. Investors and policymakers alike will be closely monitoring the situation.

NEXT: Watch for the Federal Reserve’s upcoming meeting and any potential announcements regarding interest rate adjustments. The evolving landscape of global economic indicators will play a crucial role in shaping future monetary policies across nations.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment4 months ago

Entertainment4 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Top Stories1 week ago

Top Stories1 week agoFamily Remembers Beverley Rowbotham 25 Years After Murder