Top Stories

French Inflation Rises to 1.1% in September, Below ECB Target

URGENT UPDATE: French inflation surged to 1.1% in September 2023, driven by a faster-growing services sector and a smaller decline in energy prices. However, this figure remains significantly below the European Central Bank’s (ECB) target of 2%, raising questions about the economic outlook for the euro area’s second-largest economy.

According to the national statistics agency Insee, consumer prices rose from 0.8% in August, although analysts had anticipated a stronger increase, predicting a rise to 1.3%. This unexpected development comes as inflation trends upwards across the eurozone, putting pressure on policymakers to maintain stability.

In comments made on Monday, ECB Chief Economist Philip Lane stated that the inflation outlook “is reasonably benign at this point,” suggesting that interest rates are unlikely to be cut further after the eight reductions already implemented. This sentiment reflects confidence among investors and analysts regarding economic recovery, despite current figures remaining below desired levels.

Services inflation in France climbed to 2.4% in September, up from 2.1% in August, indicating increased costs in healthcare while telecommunications prices fell less than in previous months. Energy prices also exhibited a less pronounced decline due to base effects following significant drops in oil products last September.

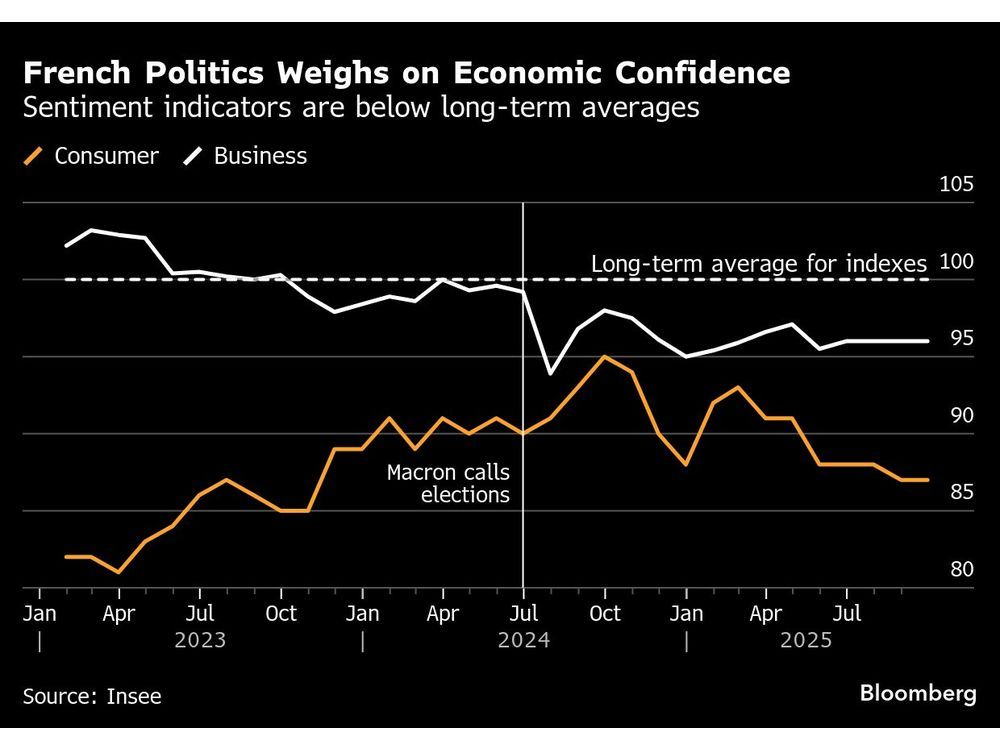

The economic landscape in France is complicated by a prolonged political crisis that worsened in September with the second government collapse in less than a year. This instability has introduced uncertainty over strategies to manage a rapidly growing debt burden, affecting both business investment and consumer spending.

In a separate report released today, Insee noted that consumer spending experienced only a 0.1% increase in August, falling short of the 0.2% rise anticipated by analysts. Additionally, July’s consumer spending was revised down to a 0.6% contraction, reflecting deeper economic challenges.

As inflation continues to trend upwards, all eyes will be on data releases from Italy and Germany later today, with broader eurozone figures set to be published tomorrow. Analysts expect the eurozone’s inflation rate to rise to 2.2%, potentially influencing further ECB policies.

Stay tuned for more updates as this story develops, and share your thoughts on the implications of France’s economic situation.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025