Top Stories

GBP/USD Faces Critical Support Level as BoE Decision Looms

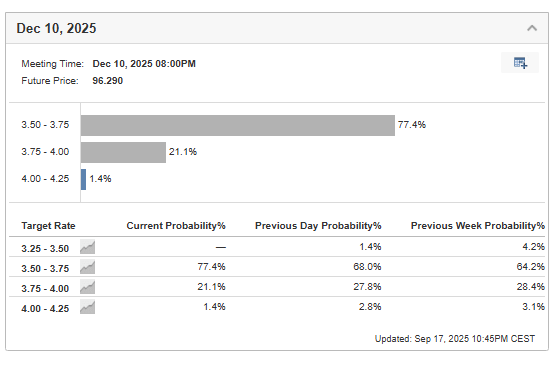

UPDATE: The GBP/USD currency pair is on the brink of a critical support level as the Bank of England (BoE) prepares to announce its latest monetary policy decision today, July 26, 2023. With the Federal Reserve having just cut rates by 25 basis points in a move that aligns with market expectations, all eyes are now on the BoE’s stance amid persistent inflation.

The BoE is expected to maintain its current interest rates, with inflation still hovering at 3.8% year-on-year. This decision could significantly impact GBP/USD volatility, especially as traders await clarity on the BoE’s approach to future cuts. With inflation remaining above target, the central bank is likely to adopt a cautious stance, potentially leading to a breach of the 1.36 support level if the tone is deemed too hawkish.

The Fed’s recent easing, coupled with a softening labor market, has set a different trajectory for U.S. monetary policy, with two more rate cuts anticipated by year-end. This divergence between the Fed and the BoE is fueling volatility across major currency pairs, creating critical trading opportunities.

As the market braces for the BoE’s announcement, traders should closely monitor the GBP/USD pair. A break below 1.36 could trigger further declines, while a rebound may see the pair challenge the long-standing resistance around 1.38.

The implications of these central bank decisions extend beyond forex markets. Investors are keenly aware that the BoE’s reluctance to cut rates could signal prolonged economic challenges in the UK, where economic growth is slowing, evidenced by a mere 1.4% growth rate year-on-year, which falls short of market expectations.

The next few hours are crucial for traders and investors alike. With the BoE’s decision imminent, market participants must prepare for potential shifts in currency value and broader market sentiment. Continuous updates will be available as the situation develops.

Stay tuned as we bring you the latest insights and developments in this fast-evolving financial landscape.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Top Stories2 weeks ago

Top Stories2 weeks agoFamily Remembers Beverley Rowbotham 25 Years After Murder

-

Top Stories4 days ago

Top Stories4 days agoBlake Snell’s Frustration Ignites Toronto Blue Jays Fan Fury