Top Stories

GBP/USD Faces Volatility as BoE Decisions Loom—Act Now!

URGENT UPDATE: The GBP/USD currency pair is poised for potential volatility following the Bank of England’s (BoE) critical decision today. With the Federal Reserve implementing a 25 basis points (bp) rate cut yesterday, all eyes are on the BoE as it navigates a complex economic landscape.

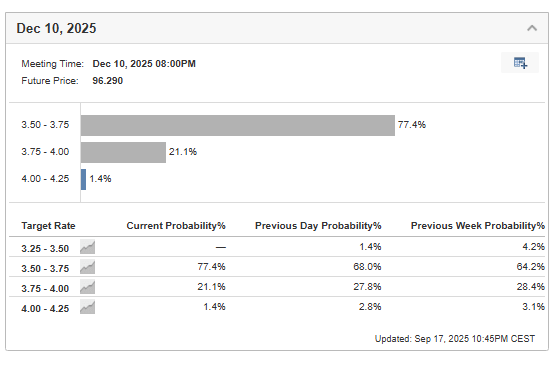

The Fed’s recent actions indicate a shift towards further easing as the U.S. labor market shows signs of weakening. However, the BoE is expected to maintain its current stance, keeping rates steady as inflation sits at 3.8%, significantly above its target. This divergence in monetary policy could lead to significant movement in the GBP/USD exchange rate.

Market analysts are closely monitoring how the BoE will respond. If officials adopt a more hawkish tone, the GBP/USD could break below the critical 1.36 support level, signaling a further decline. Conversely, a reversal in trends could see the pair attempt to overcome the 1.38 resistance level, which has proven challenging in recent months.

The backdrop of these developments is critical: the Fed anticipates two more rate cuts by year-end, while the BoE remains hesitant due to persistent inflation pressures. Today’s decision could set the near-to-medium-term direction for GBP/USD, impacting traders worldwide.

As the financial markets brace for this pivotal moment, the implications are substantial for investors. A decline in GBP/USD could lead to broader market instability, affecting everything from consumer prices to international trade.

Investors seeking actionable insights amidst this volatility can access advanced tools and strategies through platforms like InvestingPro, which offers AI-managed stock market strategies and extensive historical data for informed trading decisions.

What to watch for in the coming hours: If the BoE’s announcement indicates a cautious approach towards rate cuts, expect heightened volatility in the GBP/USD market. Traders should prepare for significant price movements as the market reacts to the central bank’s stance.

Stay tuned for live updates as this situation develops.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Top Stories2 weeks ago

Top Stories2 weeks agoFamily Remembers Beverley Rowbotham 25 Years After Murder

-

Top Stories4 days ago

Top Stories4 days agoBlake Snell’s Frustration Ignites Toronto Blue Jays Fan Fury