Top Stories

Germany Launches €100 Billion Fund to Secure Strategic Assets

URGENT UPDATE: Germany is set to launch a groundbreaking investment fund worth €100 billion (approximately $116 billion) aimed at reinforcing its strategic sectors, including defense, energy, and critical raw materials. The initiative, named the Deutschlandfonds or Germany Fund, is designed to attract international investors and bolster Germany’s economic resilience in the face of escalating geopolitical risks.

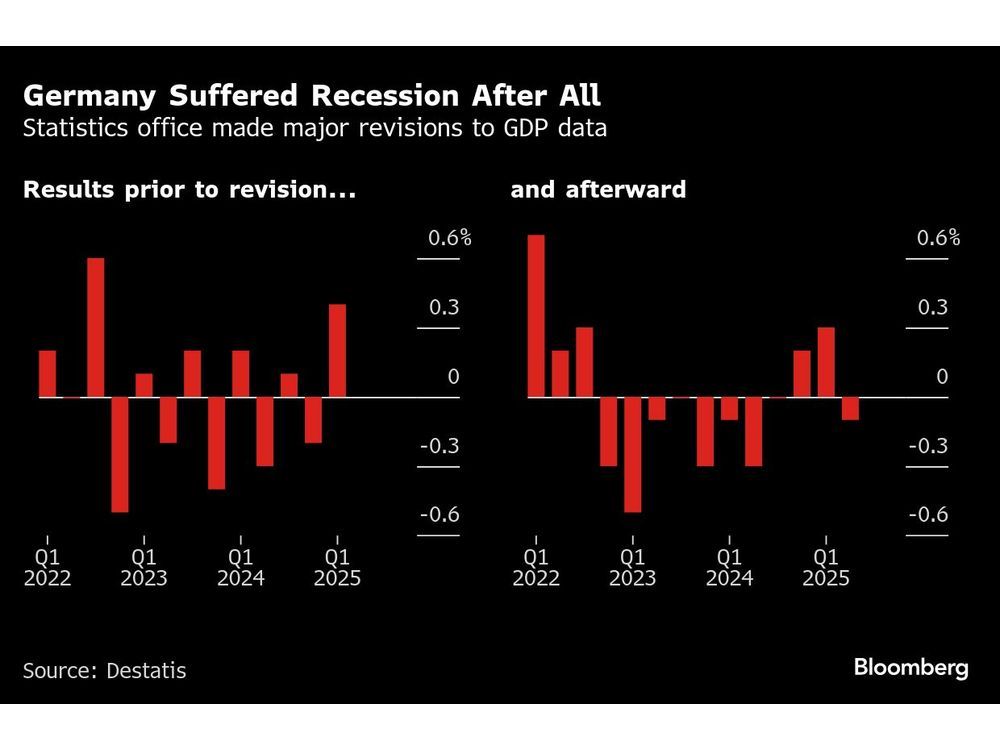

According to an announcement from the economy ministry, the fund will initially be supported by at least €10 billion in public money, with aspirations to mobilize up to ten times that amount from private capital. This strategic move comes as Chancellor Friedrich Merz‘s administration seeks to revive growth in Europe’s largest economy following two years of economic contraction.

“This fund will invest in growth, innovation, and competitiveness in partnership with private German and European investors,” the ministry stated. The urgency of this initiative reflects concerns over supply chain security, particularly in light of the ongoing conflict in Ukraine and international trade tensions.

The official launch of the fund is expected to kick off in September or October 2023, following the parliament’s summer break, as confirmed by sources familiar with the project. The government is currently negotiating the fund’s financial structure with the finance ministry and the state-development bank KfW.

Key focus areas for the Germany Fund will include energy infrastructure, where Germany is looking to consolidate control over electricity transmission networks by potentially acquiring stakes in companies like 50Hertz, TransnetBW, and the Dutch-owned power provider TenneT. Additionally, discussions are underway to secure a blocking minority stake in the Franco-German arms manufacturer KNDS and invest in defense startups.

The fund is also seen as a means to strengthen domestic capital markets, particularly for smaller and mid-sized companies that have struggled to attract investment for higher-risk projects. As a hybrid instrument between state subsidies and market-driven venture capital, the Germany Fund aims to provide international investors the confidence of government endorsement.

Despite existing tensions within Germany’s ruling coalition, the funding for this ambitious project is confirmed, following a recent clearance of a €500 billion infrastructure spending package. Notably, equity investments made through the fund will be categorized as financial transactions, thereby circumventing the country’s constitutional debt constraints.

This initiative fulfills a commitment outlined in the coalition agreement formed in May and marks an early signature project for the new Economy Minister Katherina Reiche, a former executive in the energy sector.

As Germany prepares to launch this significant economic tool, the implications for the domestic and European economy are profound. The Germany Fund is poised to reshape investment strategies and provide a crucial lifeline for strategic sectors amid a rapidly changing global landscape.

Stay tuned for further updates as this developing story unfolds.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025