Top Stories

Global Stocks Surge as Tech Optimism Fuels Market Rally

UPDATE: Global stocks are surging today, climbing for a fifth consecutive day, driven by booming optimism in the technology sector. As of this morning, the MSCI all-country stock index is on track for yet another record high close, bolstered by major tech players like Taiwan Semiconductor Manufacturing Co. and Alibaba Group Holding Ltd..

The positive sentiment is spreading rapidly across Asia, with shares in South Korea, Taiwan, and Hong Kong seeing significant gains. However, the mood is dampened in Indonesia, where the abrupt removal of Finance Minister Sri Mulyani Indrawati has sparked financial turmoil, causing local stocks to decline by as much as 1.8%.

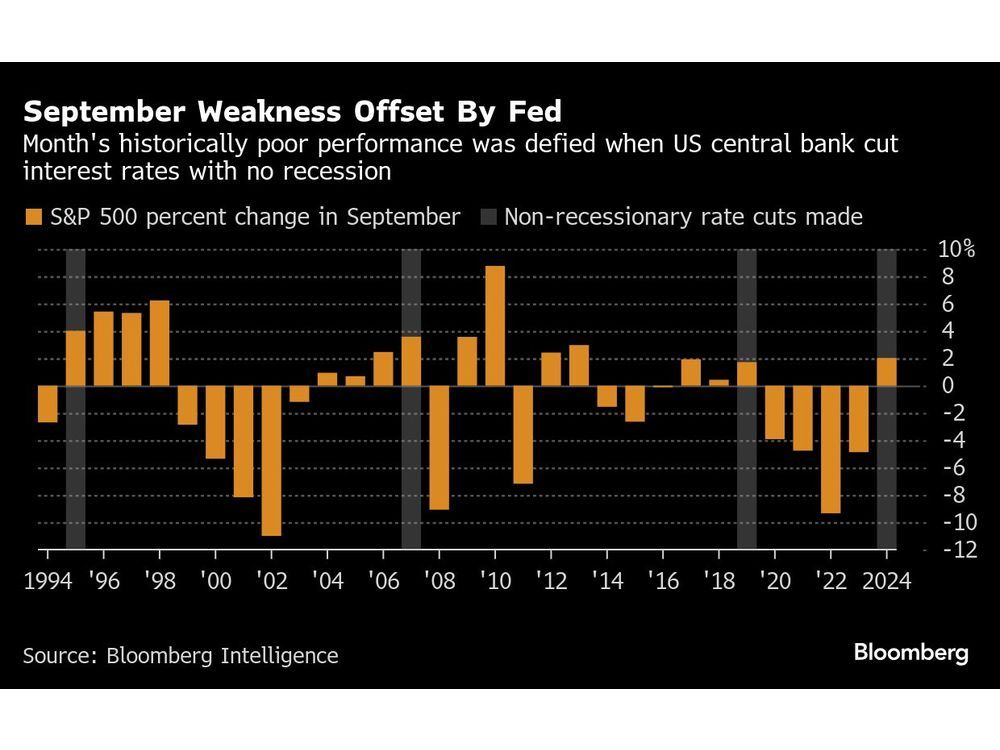

Market analysts attribute the rally to heightened expectations for U.S. interest-rate cuts, which have fueled a buying spree in tech stocks. The S&P 500 reached a near-record high on Monday, and futures are advancing further today. Tim Waterer, chief market analyst at KCM Trade, stated, “Investors are still seeing upside growth potential in the tech space, which is why the buying flows into the sector are continuing.”

In Japan, the Nikkei 225 index achieved a new intraday record today before slightly retracting. The resignation of Prime Minister Shigeru Ishiba has raised expectations for looser fiscal policy, further impacting market dynamics. Meanwhile, China’s export growth has slowed to its weakest in six months, although sales to alternative markets are helping maintain a record trade surplus.

Investor confidence is shaky in Indonesia following President Prabowo Subianto’s sudden decision to replace Indrawati. The move has raised concerns over fiscal stability, prompting the rupiah to slide against the dollar. Mary Nicola, Markets Live strategist, warned, “Indonesian assets face renewed pressure… policy continuity will be vital to maintain investor confidence.”

As global markets react, the U.S. Federal Reserve is anticipated to announce nearly three rate cuts this year, starting this month, as inflation data remains a significant concern. Traders eagerly await the core consumer price index report on Thursday, projected to show a 0.3% increase for August.

In corporate news, the London-listed Anglo American Plc is nearing a landmark acquisition of Canada’s Teck Resources Ltd., potentially marking the biggest mining deal in over a decade. Oil prices have also risen for the second straight day amid apprehensions regarding softening demand.

Global financial markets are poised for further volatility as they adjust to these rapidly shifting dynamics. As Frederic Neumann, HSBC’s chief Asia economist, noted, “For the next several days, markets in Asia are likely to take their cue from the U.S., with few regional catalysts in sight.”

Investors are advised to stay alert as key economic data is expected to shape the trajectory of markets in the coming weeks. The interplay between U.S. monetary policy and regional economic developments will be crucial in determining market stability.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 weeks ago

Top Stories2 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics2 weeks ago

Politics2 weeks agoShutdown Reflects Democratic Struggles Amid Economic Concerns