Top Stories

Gold Surges to Record High Amid Rate-Cut Bets and Economic Fears

UPDATE: Gold prices skyrocketed to an all-time high of $3,540.04 per ounce as of today, following heightened expectations of imminent U.S. interest rate cuts and growing economic anxieties. The precious metal’s surge marks a significant 1.8% increase in just one day, maintaining a six-day rally that reflects traders’ increasing demand for safe-haven assets amidst a volatile financial landscape.

The financial markets are experiencing a risk-off mood, with renewed fears surrounding the Federal Reserve’s direction and rising budget concerns in developed nations. These factors have pressured equity and bond markets, prompting investors to flock to gold for stability. As of 7:24 a.m. in Singapore, spot gold adjusted slightly to $3,529.33 per ounce but remains significantly elevated.

Gold has soared over 33% this year, solidifying its position as one of the best-performing major commodities. Analysts attribute this rally to expectations that the central bank will lower rates later this month. Fed Chair Jerome Powell has hinted at a possible reduction, which is crucial for non-yielding assets like gold.

The upcoming U.S. jobs report this Friday is expected to provide further evidence of a cooling labor market, bolstering the case for rate cuts. Lower interest rates typically diminish the opportunity cost of holding gold, making it more attractive to investors.

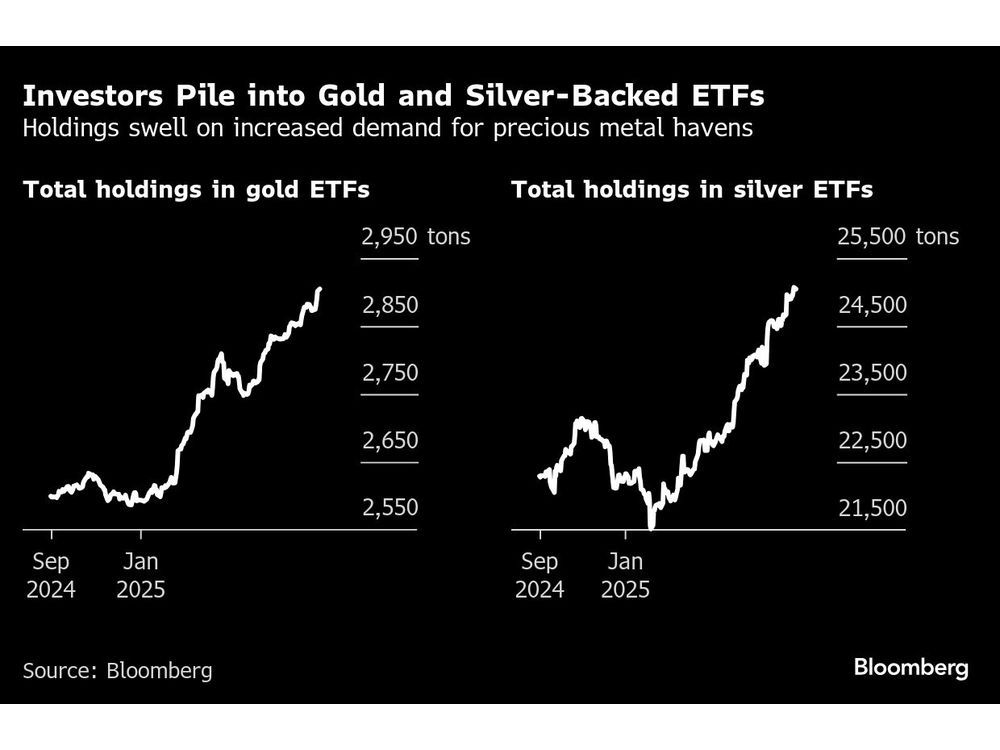

Both gold and silver have seen remarkable appreciation, with silver prices recently surpassing $40 an ounce for the first time since 2011. Silver’s rise, up approximately 40% this year, is fueled not just by investment demand but also by its industrial applications in clean energy technologies.

As the market braces for further developments, President Trump’s escalating critiques of the Fed add another layer of uncertainty. His administration is seeking a Supreme Court ruling on whether he has grounds to remove Fed Governor Lisa Cook, which could allow for the appointment of a more dovish official. The outcome may significantly impact market sentiments.

“Gold’s impressive performance reflects mounting geopolitical and economic risks,” noted a market analyst. “Investors are increasingly seeking the safety of gold and silver as uncertainties loom large.”

On the legislative front, Trump plans to expedite a ruling to overturn a federal court decision regarding his tariffs, adding complexity to trade negotiations and economic forecasts. This legal uncertainty has left American importers in a precarious position, which could delay anticipated economic benefits.

As we look ahead, the market is poised for its fifth consecutive year of deficits in silver, indicating persistent tightness. The Silver Institute reports that this ongoing demand has resulted in a significant drawdown of stockpiles, leading to elevated lease rates around 2%.

Investors are closely watching the upcoming announcements from Treasury Secretary Scott Bessent, who is set to interview candidates for the next Fed Chair starting this Friday. The decisions made in the coming days are likely to influence market dynamics significantly.

In summary, gold’s record-setting prices are a direct response to economic fears and strategic shifts in U.S. monetary policy. With the potential for further rate cuts and ongoing uncertainties, investors are urged to stay informed as these developments unfold.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025