Top Stories

Indian Defense Stocks Plunge as China Tensions Ease; Tax Cuts Impact Urgent

UPDATE: Indian defense stocks are experiencing a significant decline today as geopolitical tensions with China ease, leading to reduced urgency for military spending. The latest trading data shows a lagging performance in the defense sector, which has caused investor concern about stock valuations built on geopolitical risk premiums.

Market analysts report that the Nifty defense index is trailing behind its peers as of October 16, 2023. The easing of tensions with China, along with Prime Minister Narendra Modi‘s recent tax cuts, has not boosted investor sentiment. Nifty futures are trading lower, indicating a lack of enthusiasm among bulls as global markets show mixed signals.

In addition, the proposed cuts to the goods-and-services tax on insurance premiums could further complicate market dynamics. Insurers are concerned that a reduction to 5% or even zero would eliminate access to input tax credits, exposing them to potential double taxation and eroding profit margins. This could jeopardize the financial stability of insurance companies amid a broader market rally.

Despite the turmoil in the defense sector, the IPO market is buzzing with activity today, with four new offerings launching. This optimism, however, is overshadowed by the troubling outlook for defense stocks. Analysts emphasize that reduced urgency for arms spending could deflate valuations quickly, reminding investors of the volatility associated with geopolitical risk.

Maharashtra, home to Mumbai, is also making headlines with a new initiative to promote locally made liquor. This could reshape the competitive landscape, although high taxes on alcohol remain a significant hurdle. Experts suggest that while this move aligns with Modi’s broader push to stimulate consumption, it may not provide immediate relief for distillers facing high levies.

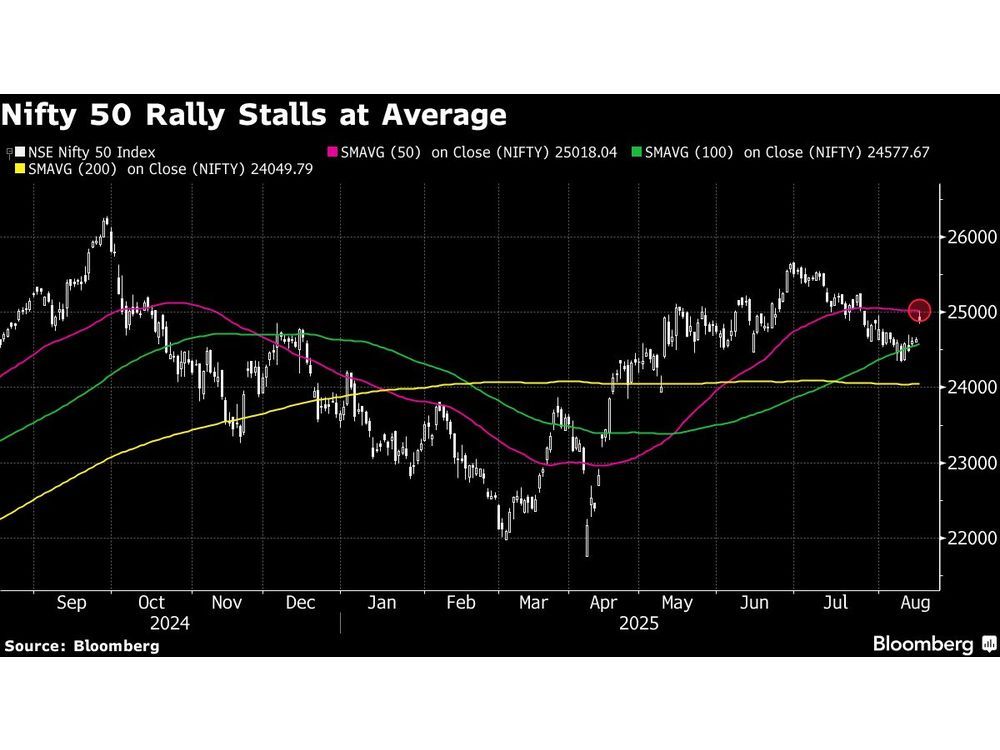

Looking ahead, market watchers are advised to focus on the implications of these developments. The challenge for defense stocks, coupled with insurer concerns, may influence market trends in the coming days. The Nifty 50 Index also faces resistance at the 50-day moving average, a technical barrier that has repeatedly halted previous rallies.

As the market adjusts to these changes, investors are encouraged to stay informed about the evolving landscape. For more updates on market movements, follow Bloomberg India on WhatsApp.

This urgent news highlights how global dynamics and domestic fiscal policies are shaping the Indian market landscape. The implications of these developments are critical for investors, and immediate attention is required as the situation unfolds.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025