Top Stories

Indian Markets Face Continued Decline as Earnings Disappoint

Indian stock markets are poised to experience their third consecutive week of losses, a trend not observed since early March. The ongoing downturn is primarily attributed to high valuations and a disappointing earnings season, particularly from the information technology sector, which has delayed hopes for recovery. Notably, all eyes are now on Reliance Industries, set to announce its first-quarter results later today.

Investors are grappling with waning enthusiasm for Indian equities. Following a period of optimism when India was seen as a safe haven due to its domestic-centered economy, this sentiment is shifting. Citigroup Inc. has downgraded Indian stocks from “overweight” to “neutral,” citing sluggish earnings and inflated valuations as key concerns. Similarly, a recent Bank of America survey of Asia fund managers indicates that India has slipped in its ranking among favored markets in the region.

Mutual Funds Ramp Up Investments

Despite the downturn in stock prices, Indian mutual funds are rapidly deploying capital at their fastest rate since the peak of the pandemic. According to Elara Securities, actively managed funds recorded a 1.3 percentage point decline in cash levels, marking the quickest investment pace since July-August 2020. Much of this capital has been directed towards the thriving primary market, with strong initial public offerings (IPOs) such as that of HDB Financial Services bolstering investor confidence.

Surge in Demand for Cables and Wires

In a different sector, India’s $10 billion cables and wires industry is preparing for robust growth. Analysts at JM Financial predict a compound annual growth rate of 12% over the next three years. This surge is driven by rising investments in renewable energy and a significant expansion in data centers. Major players like UltraTech and the Adani Group are entering the space, which may challenge smaller, unorganized players while providing a boost to established producers. JM Financial has identified its top stock picks in this segment, including Polycab, KEI Industries, and RR Kabel.

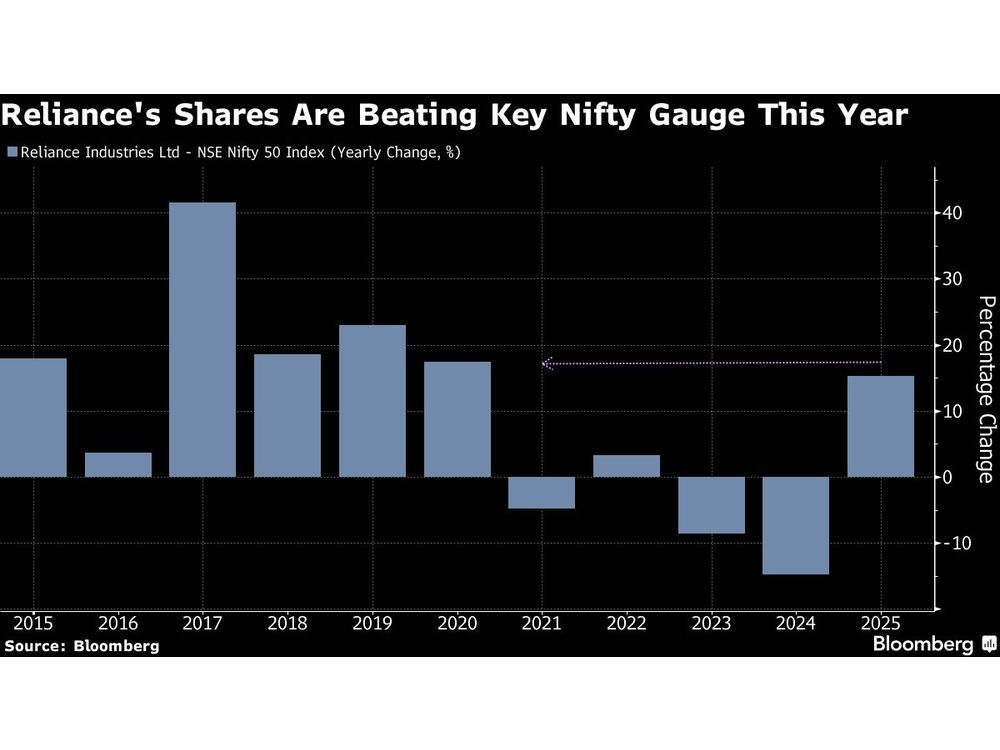

As the market grapples with these trends, the upcoming earnings report from Reliance Industries is highly anticipated. Shares of the company have recently begun to outpace the nation’s key benchmark index for the first time in two years. Investors are hopeful for a strong quarterly profit report, which is expected to show the steepest growth in three years. Attention is also focused on any indications regarding potential listings of its significant business units.

The Indian markets reflect a complex landscape where high hopes are tempered by current realities. Stakeholders will be closely watching forthcoming earnings reports and market movements as they navigate this challenging environment.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025