Top Stories

Indonesia Urgently Reviews Budget Deficit Law Amid Economic Concerns

UPDATE: Indonesia’s parliament has just announced a critical review of the law governing the nation’s budget deficit and debt levels, with implications set to impact the economy immediately. This decision comes as part of a sweeping legislative agenda for 2025, highlighting a renewed focus on fiscal discipline against a backdrop of rising economic concerns.

The proposed review of the State Finance Law, which has capped the fiscal deficit at 3% of gross domestic product (GDP) and total debt at 60% of GDP since its enactment in 2003, is among the 67 priorities slated for discussion when parliament reconvenes in January. The law’s limits are critical for investors, and any changes could escalate market volatility.

Following this announcement, the Indonesian rupiah has dropped 0.4% against the U.S. dollar, while the benchmark 10-year bond yield has increased by 1.3 basis points. Stock markets have also reacted negatively, slipping by 0.1% as uncertainty looms over fiscal policy.

Investors and analysts are on alert, particularly with newly appointed Finance Minister Purbaya Yudhi Sadewa indicating a push to accelerate economic growth beyond 6%, up from the stagnant 5% pace observed over the past decade.

“Fiscal health has been already one of the investors’ concerns. Any new uncertainties will add to the cautiousness in the market,”

stated Jeffrey Zhang, an emerging markets strategist at Credit Agricole CIB in Hong Kong.

The State Finance Law was originally passed in the aftermath of the 1998 Asian financial crisis, during which Indonesia required assistance from the International Monetary Fund (IMF). The legislation was designed to instill fiscal discipline, ensure macroeconomic stability, and boost investor confidence by aligning with international standards.

As Indonesia’s parliament prepares for its session, it is also fast-tracking another significant bill aimed at empowering law enforcement to confiscate assets tied to corruption, responding to public demands raised during recent protests. This includes proposals for tax amnesty and legislative changes surrounding police operations and upcoming elections.

The urgency of these discussions cannot be overstated, as the potential for increased government spending raises fears of breaching established fiscal limits. Investors and citizens alike are watching closely as Indonesia seeks to navigate its economic future while maintaining fiscal integrity.

What happens next? Stakeholders will be keenly observing the parliamentary debates in January, where the outcomes could redefine Indonesia’s fiscal landscape and influence overall economic stability. As new details emerge, the financial community will be assessing the implications for both domestic and international investment strategies.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

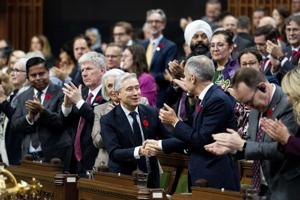

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025