Top Stories

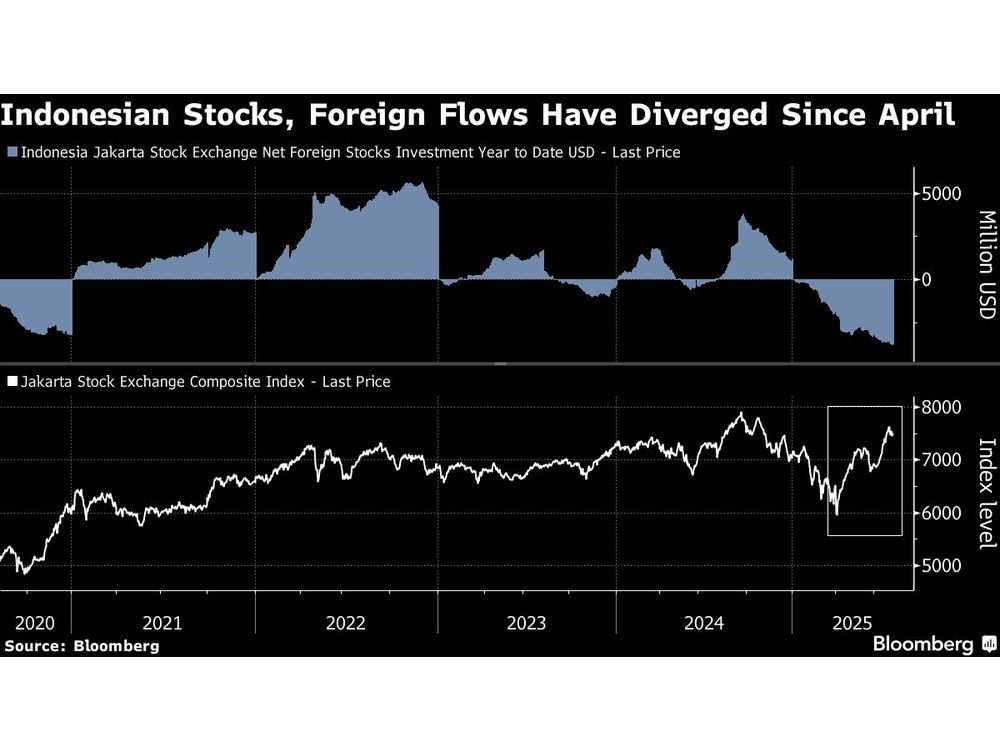

Indonesian Stocks Surge Toward Record High Despite $3.8B Outflow

UPDATE: Indonesian stocks are on the brink of a historic high, as the Jakarta Composite Index rallies despite a staggering $3.8 billion in foreign selling this year. This year is shaping up to be the largest annual outflow of foreign investment in the country’s history, according to Bloomberg data.

As of now, the index has surged 26% since hitting a low in April, drawing closer to its all-time high set in September. This remarkable growth underscores a significant shift in market dynamics, with local demand increasingly driving the market.

While foreign investors have fled the market, local retail participation has exploded. The number of retail investors in Indonesia has skyrocketed to 17 million in 2025 from just 3.8 million five years ago, as reported by the Indonesia Stock Exchange. This surge in local investment is helping to offset concerns over global trade and foreign capital withdrawals.

“Domestic investors are backing a new generation of winners,” said Mohit Mirpuri, a fund manager at SGMC Capital Pte. “If this trend holds, a fresh record high could just be the beginning for Indonesia’s equity gauge.”

Investors are particularly enthusiastic about stocks linked to billionaires, such as Prajogo Pangestu’s PT Barito Renewables Energy, which has seen its stock price soar over 800% since its debut in 2023. Another standout, PT Chandra Daya Investasi, has surged an astonishing 837% since being listed just last month, further energizing local investor sentiment.

The declining yields on government bonds are also prompting domestic investors to seek higher returns in stocks. Indonesia’s benchmark 10-year bond yield has decreased by more than 50 basis points this year, settling at 6.5%.

Market experts believe that a softer U.S. dollar and potential interest rate cuts by Bank Indonesia could entice foreign investors back into the market. Additionally, the recent decision by U.S. President Donald Trump to reduce tariffs on Indonesian imports from 32% to 19% has bolstered market confidence.

“A softer dollar and greater certainty over global trade could lure foreign investors back,” noted Rajeev De Mello, global macro portfolio manager at Gama Asset Management.

Despite the positive outlook, analysts warn that foreign selling could continue if corporate earnings fail to meet expectations. Aldo Perkasa, head of research at PT Trimegah Sekuritas Indonesia, predicts the benchmark index may close the year at 7,750 points, representing a 3.1% increase from Tuesday’s close.

As the market continues to evolve, all eyes will be on Indonesia’s stocks as they near unprecedented heights amidst foreign selling pressures. Investors are eagerly watching for the potential for record-breaking performance in the coming weeks.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025