Top Stories

Intel Shares Soar as SoftBank Agrees to $2 Billion Investment

UPDATE: Intel shares surged today after Japanese investment powerhouse SoftBank confirmed it is acquiring a $2 billion stake in the U.S. chip giant. The announcement, made just hours ago, has electrified the market, reflecting growing confidence in the semiconductor sector.

The investment is set at $23 per share and comes amid significant developments involving the Trump administration, which is reportedly in talks to secure a 10% stake in Intel by converting government grants into equity. This potential deal aims to bolster Intel’s plans for a major manufacturing hub in Ohio, a move critical for U.S. semiconductor production and technological independence.

Both companies released a joint statement emphasizing their commitment to advancing technology and semiconductor innovation in the United States. This strategic partnership represents a significant boost for Intel, which has faced increasing scrutiny over its supply chain and production capabilities.

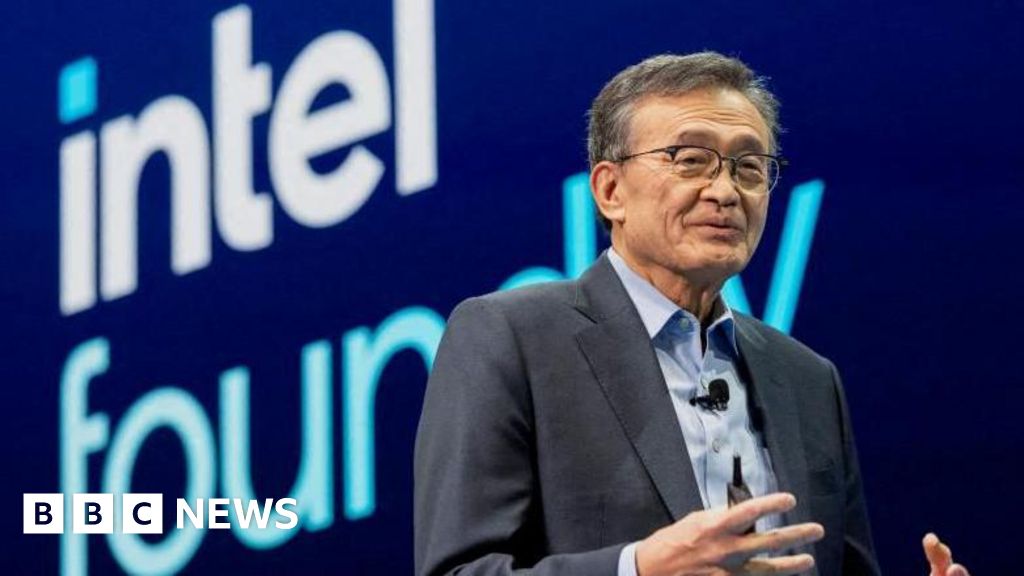

Just last week, Intel’s CEO, Lip-Bu Tan, met with President Donald Trump and members of his cabinet. This meeting followed Trump’s earlier remarks calling for Tan’s resignation, citing concerns over his prior ties to China. The situation underscores the intense pressure the U.S. chip industry is under, particularly as global tech competition heats up.

In a related development, semiconductor leaders Nvidia and AMD recently agreed to pay the U.S. government 15% of their Chinese revenues to secure export licenses, further highlighting the administration’s focus on regulating the chip sector.

As the market reacts to this news, investors are keenly watching how these developments will reshape the landscape of the semiconductor industry in the coming months. With SoftBank’s significant investment, Intel is poised to enhance its technological capabilities while navigating the complex geopolitical environment surrounding U.S.-China relations.

Expect more updates as this story develops. The implications of these investments could ripple through the technology sector, affecting not only stock prices but also the future of American manufacturing and innovation. Stay tuned for further details as we monitor this evolving situation.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025