Top Stories

Norway’s Election Could Shift Wealth Taxes, Fund Investments Urgently

UPDATE: Norway’s pivotal elections are set to close at 9 p.m. Monday, with significant implications for wealth taxes and the nation’s $2 trillion sovereign wealth fund. Voters face critical choices that could reshape tax policies impacting the wealthiest citizens and alter investment strategies in a rapidly changing geopolitical landscape.

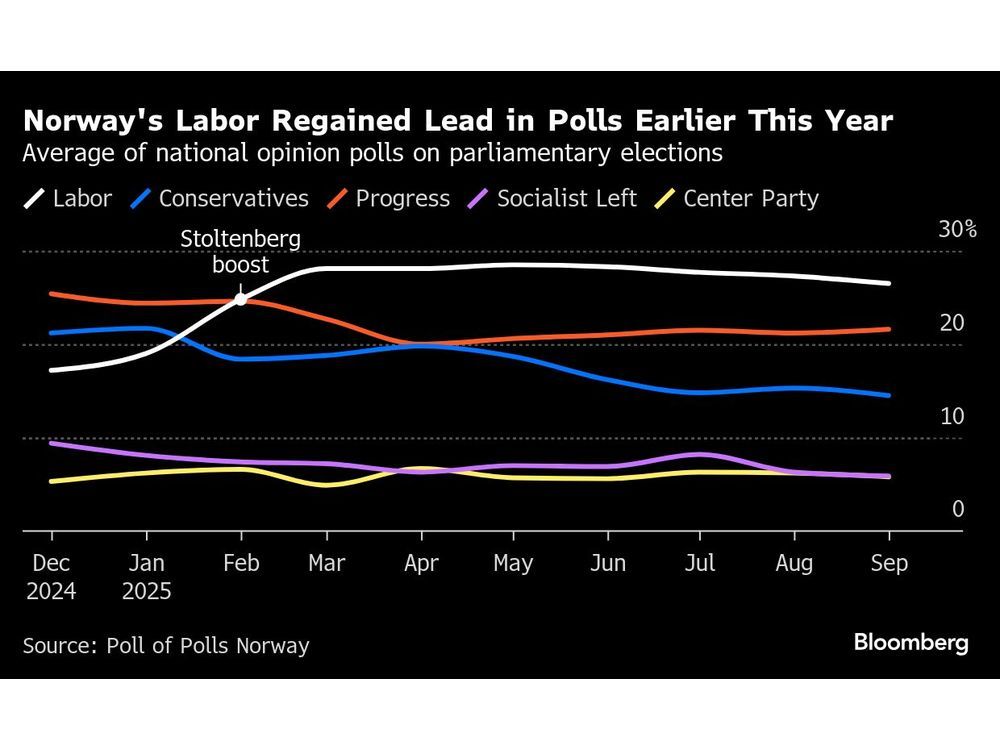

Labor Prime Minister Jonas Gahr Støre seeks to maintain his grip on power in what is shaping up to be a close contest. His party has gained momentum following the return of former NATO chief Jens Stoltenberg to the political forefront. However, Støre’s administration faces mounting criticism from the business sector and right-wing opposition over controversial wealth taxes that many argue hinder economic growth.

The Progress Party, led by Sylvi Listhaug, is emerging as a formidable opponent, promising to eliminate the wealth tax currently set at 1.1% on fortunes exceeding 20 million kroner ($2 million). This tax has reportedly driven around 500 of Norway’s wealthiest citizens to leave the country, according to estimates from DNB Bank ASA.

With speculation surrounding potential policy changes, the stakes are high for various sectors, including energy and defense. Both the Progress Party and the Conservative Party have committed to revisiting restrictions on the sovereign wealth fund, allowing it to invest in companies in the nuclear arms industry, a shift from current ethical guidelines amid rising defense demands driven by the ongoing conflict in Ukraine.

Economic forecasts indicate that Norway’s growth, excluding offshore energy, is projected to surge to 1.6% this year, a significant rise from 0.6% in 2024. The country’s stock index has already rallied approximately 14% thus far in 2025, outperforming its European counterparts.

In addition to potential changes in tax policies, the election will also influence energy policies. While there is a consensus among major parties on increasing oil and gas drilling to ensure energy security, smaller parties are advocating for a quicker transition to renewable sources. A key project includes the electrification of Norway’s largest liquefied natural gas facility in Hammerfest, operated by Equinor ASA, aiming to reduce carbon emissions significantly.

As the clock ticks down to the election, analysts are closely watching how these developments will impact Norway’s fiscal policies. Approximately 20% of the national budget currently relies on returns from the sovereign wealth fund, underscoring the importance of the upcoming decision.

The results are expected to resonate beyond Norway’s borders, influencing investor sentiment and economic strategies across Europe. As the electorate heads to the polls, the world will be watching how their decisions will shape the future of Norway’s economy and its role on the global stage.

Stay tuned for immediate updates as the results unfold.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 weeks ago

Top Stories2 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics2 weeks ago

Politics2 weeks agoShutdown Reflects Democratic Struggles Amid Economic Concerns