Top Stories

Oil Markets React to Trump’s Urgent Ukraine Talks with Zelenskiy

UPDATE: Oil markets are experiencing heightened attention following President Donald Trump’s urgent meeting with Ukrainian President Volodymyr Zelenskiy. Traders are closely monitoring the implications for regional stability and energy flows as crude oil prices hover near $63 a barrel after a 1% gain on Monday.

In a significant development, Trump announced he is facilitating discussions between Zelenskiy and Russian President Vladimir Putin, aiming to broker a pivotal summit. This potential meeting, which includes plans for a trilateral discussion with European leaders, marks a critical turn in efforts to resolve a conflict that has persisted for over three years. As global tensions mount, the stability of energy markets hangs in the balance.

Asian stock markets are bracing for a mixed opening following the S&P 500’s relatively unchanged close. The yield on 10-year Treasuries rose by two basis points, reflecting investor sentiment amid these geopolitical developments. The Bloomberg Dollar Spot Index increased by 0.2%, indicating market reactions to these urgent talks.

Market analysts are raising concerns as oil prices sit more than 10% lower this year, fueled by worries surrounding US trade policies and an oversupply outlook. The upcoming Federal Reserve’s Economic Policy Symposium in Jackson Hole, Wyoming, beginning on August 24, is expected to be pivotal, with Chair Jerome Powell likely to unveil new policy frameworks that could influence economic stability.

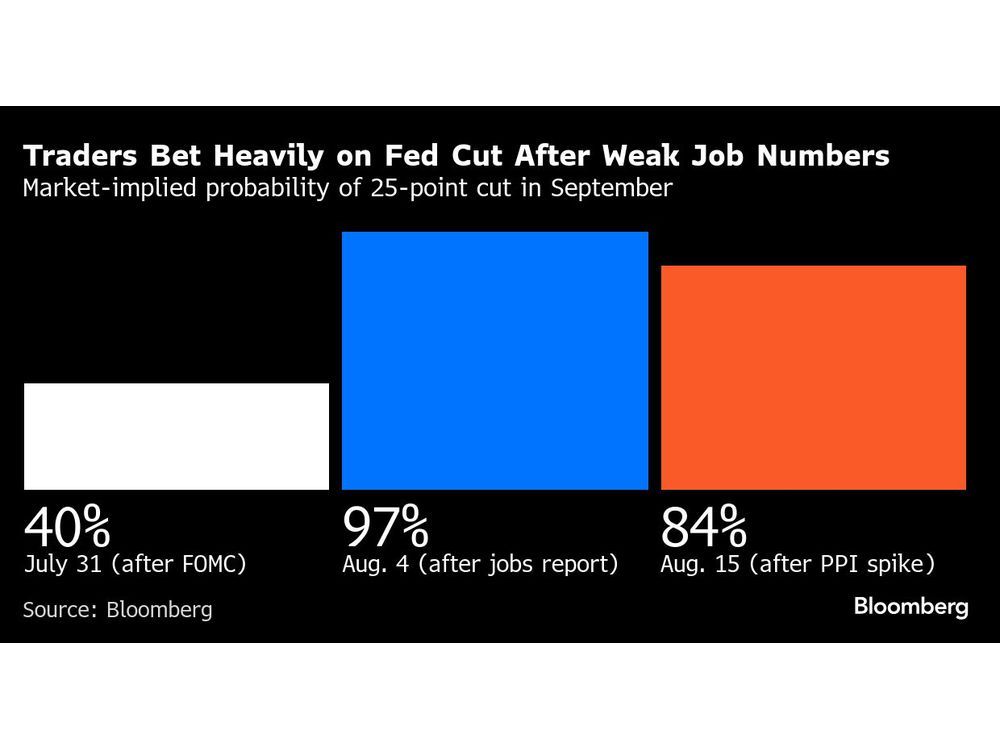

As the labor market shows early signs of weakness, analysts predict that the Fed will face pressure to cut interest rates. Current market sentiment suggests an approximately 80% chance of a 25 basis points reduction in September, as traders adjust their expectations following disappointing July employment reports.

Chris Larkin from E*Trade noted, “The market appears to be betting that signs of labor-market weakness will outweigh inflation risk in the Fed’s rate-cutting debate.” This shift emphasizes the urgency for investors to stay alert to upcoming developments, particularly Powell’s address on August 25.

In the commodities sector, West Texas Intermediate crude has dipped slightly to $63.32 a barrel, as uncertainty looms over the market’s future direction. Meanwhile, gold prices remained steady, reflecting cautious investor sentiment.

As these events unfold, the implications for global markets are profound. Stakeholders are urged to stay informed as developments regarding US-Russian relations and Federal Reserve policies continue to evolve. The next few days could prove crucial for both energy prices and broader economic forecasts.

Expect further updates as this situation develops—this is a critical moment for oil markets and international relations.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025