Top Stories

Philippines Maintains Accommodative Policy as Inflation Hits 6-Year Low

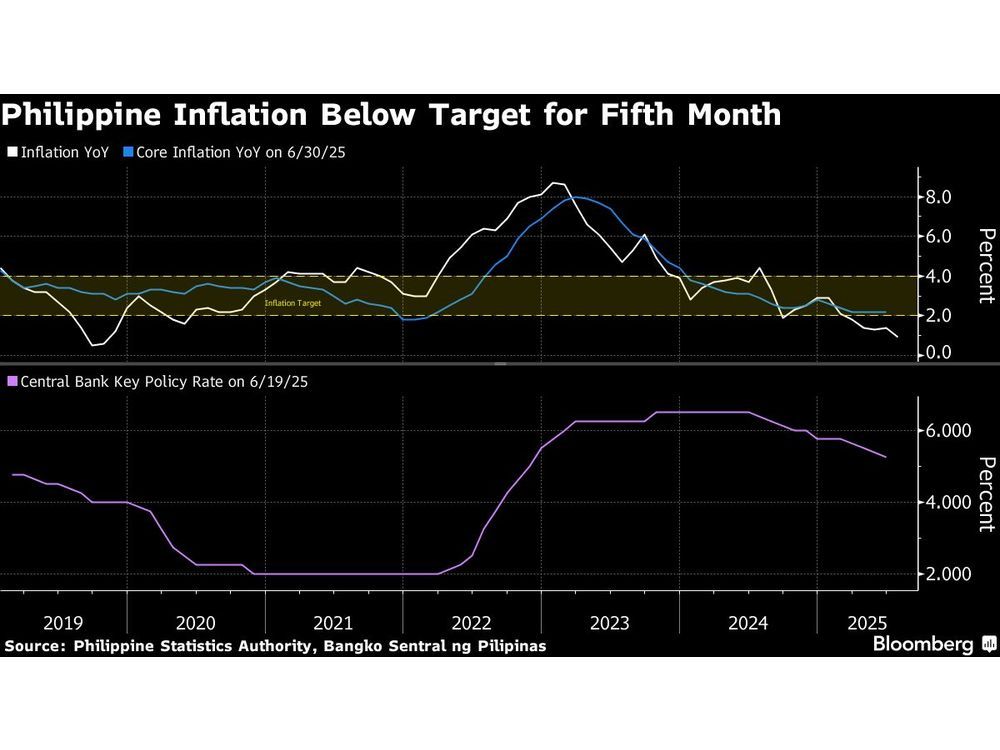

UPDATE: The Philippine central bank has confirmed it will maintain its accommodative monetary policy following a significant drop in inflation rates, now at a six-year low. As of July 2023, the inflation rate fell to 0.9%, down from 1.4% in June, marking a pivotal moment in the country’s economic landscape.

This decline in inflation is primarily attributed to a record 15.9% drop in rice prices, a staple that makes up approximately 9% of the consumer price index. The Bangko Sentral ng Pilipinas (BSP) noted this is the fifth consecutive month that inflation has remained below their target range of 2%-4%, paving the way for potential interest rate cuts as early as August 28.

In an official statement, BSP Governor Eli Remolona emphasized that a more accommodative stance is still warranted, fueling expectations for a reduction in the benchmark rate. The current overnight target reverse repurchase rate stands at 5.25%, the lowest in nearly three years. This monetary easing is vital for stimulating economic growth amid global uncertainties and slower-than-expected GDP growth, which the government recently revised to 5.5%-6.5% for the year.

Despite the positive inflation news, the Philippine peso saw a slight decrease of 0.1% against the dollar. Market analysts suggest that maintaining low inflation in the face of economic challenges may provide the BSP with further leeway to adjust interest rates. Economist Tamara Mast Henderson from Bloomberg Economics remarked that the combination of low inflation and subdued growth forecasts gives the BSP room to ease policy further, especially if the peso can maintain its year-to-date gains.

While the reduction in rice prices has eased immediate inflation pressures, it has led to calls from the Department of Agriculture for a temporary halt on rice imports and an increase in tariffs to safeguard local farmers. This could exert upward pressure on rice prices in the future, adding another layer of complexity to the economic outlook.

As the situation develops, all eyes are on the upcoming BSP meeting where further monetary decisions will be made. With inflation at a historic low, the central bank’s actions in the coming weeks will be crucial for the Philippine economy. Stay tuned for more updates as this story unfolds.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025