Top Stories

Poland Central Bank to Cut Rates Again as Inflation Drops

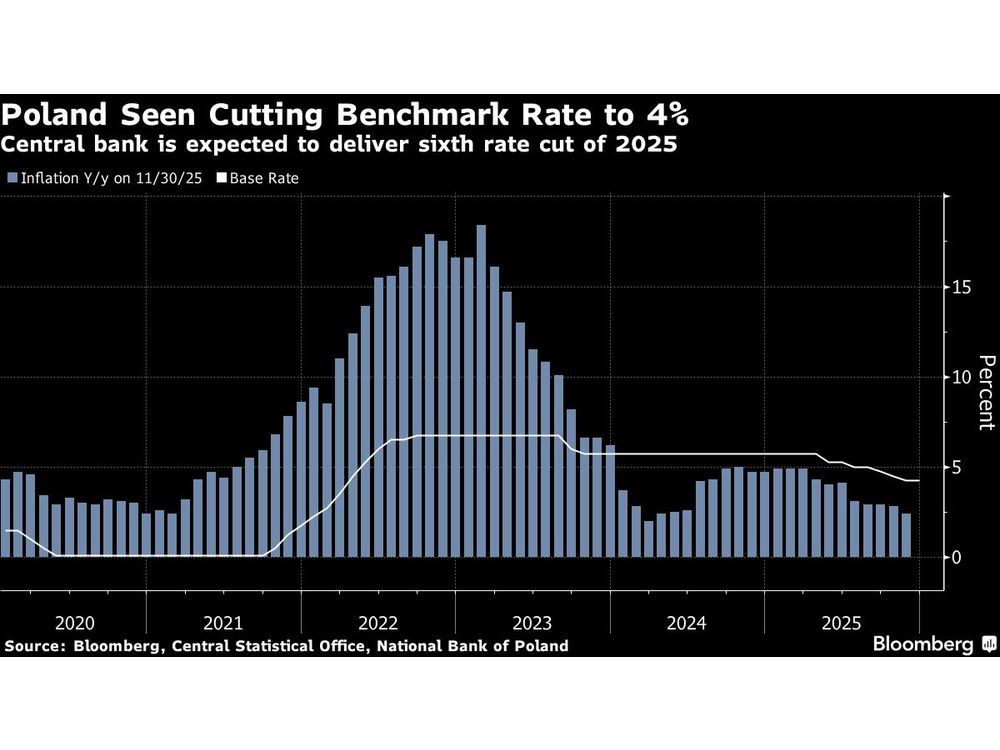

UPDATE: Poland’s central bank is set to announce its sixth interest rate cut of the year, with a reduction of 25 basis points expected to bring the key rate down to 4%. This decision comes as inflation continues to decline, now at 2.4% as of November 2023, significantly below the bank’s target.

The Monetary Policy Council (MPC) is poised to make this crucial announcement on Wednesday, marking the fifth consecutive cut aimed at addressing softening inflation. The anticipated rate drop to 4% would be the lowest level since March 2022, according to a survey of 27 out of 32 economists by Bloomberg.

This decision is essential as it signals the central bank’s response to changing economic conditions. Governor Adam Glapinski has hinted that further cuts could be possible, although no specific timeline has been provided. The shift to a lower rate reflects the MPC’s assessment that a 4% rate may still be appropriate if inflation stabilizes.

Inflation has plummeted from 4.9% at the start of the year, prompting discussions among MPC members about additional easing measures in December if the trend continues. Noteworthy members, including Wieslaw Janczyk and Ireneusz Dabrowski, have indicated that the current economic data supports a more accommodating monetary policy.

“Taking our inflation forecast at face value, we struggle to see the terminal rate at 4%,” stated Juan Orts, an economist at Societe Generale SA, suggesting that continued favorable inflation trends may push the MPC to consider even lower rates in the future.

Orts predicts that inflation will remain below the MPC’s 2.5% target next year, with a further benchmark reduction to 3.5% anticipated in the second quarter of 2024. The recent trend of rate cuts, including a surprise cut in October, indicates a significant shift in the MPC’s approach.

Governor Glapinski, who had previously supported maintaining higher rates through 2024 due to concerns over fiscal policy and energy price uncertainties, has softened his tone in recent months. He is scheduled to hold a press conference on Thursday at 3 p.m., where further insights into the MPC’s strategy are expected.

This developing situation is crucial for both consumers and businesses, as lower interest rates can lead to increased borrowing and spending, potentially boosting the economy. Investors and analysts across Europe will be closely monitoring this decision, as it reflects broader economic trends and impacts financial markets.

Stay tuned for updates as this story develops and the central bank’s decision is confirmed.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025