Top Stories

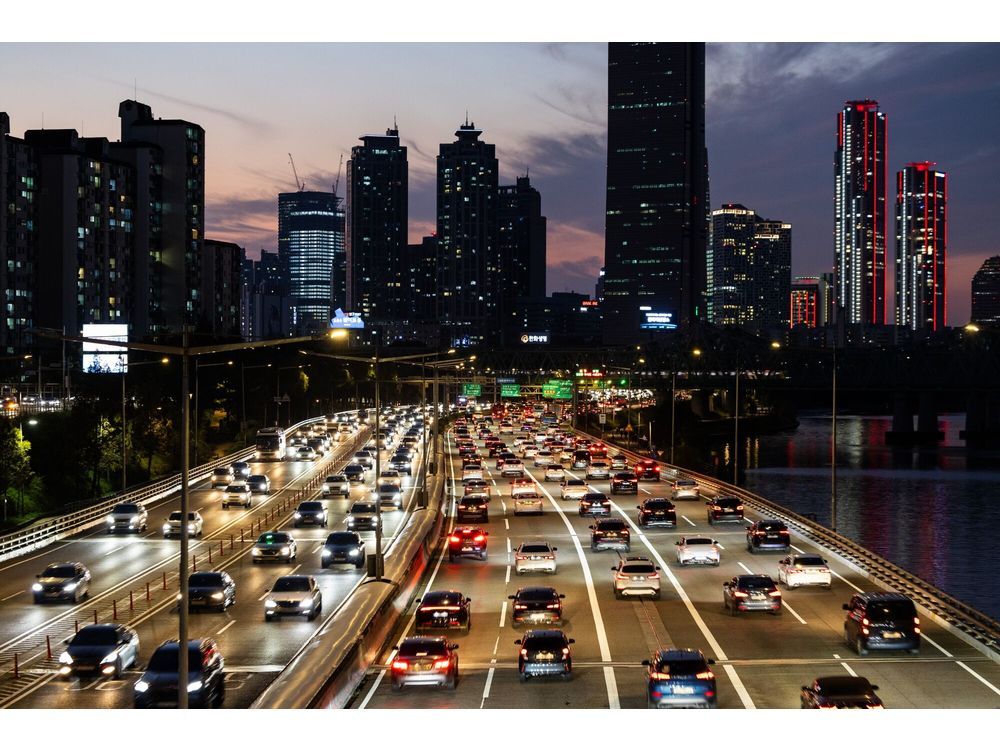

South Korea Faces Slowest Economic Growth Since Pandemic Shock

UPDATE: South Korea’s economic outlook is grim as projections indicate a mere 0.9% growth for 2025, the slowest pace since the pandemic’s devastating impact in 2020. This urgent forecast comes amidst fears that new U.S. tariffs will disrupt commerce significantly in the coming months.

The government has reported that while exports initially remained resilient—with manufacturers rushing shipments to beat impending tariffs—data from early August shows a concerning 2.7% dip in exports to the U.S., following a modest 1.4% rise in July. This trend raises alarms about the fragile state of South Korea’s economy, heavily reliant on international trade.

As Asia’s fourth-largest economy grapples with these challenges, authorities are on high alert, monitoring economic indicators closely. The situation is exacerbated by the aftermath of a political crisis triggered by former President Yoon Suk Yeol’s controversial attempt to impose martial law.

In response to the economic pressures, the South Korean government has approved a supplementary budget of 31.8 trillion won (approximately $23.3 billion) and is set to introduce a support package worth 45.8 trillion won to enhance supply chain resilience. Deputy Finance Minister Yoon Indae emphasized, “Our main goal under the current administration is to lift the potential growth rate. There is no room to retreat.”

Economists remain divided on whether the Bank of Korea will lower its benchmark interest rate during its policy meeting scheduled for August 28. Governor Rhee Chang Yong indicated that four members of the board are open to a rate cut in the near future, which could play a crucial role in stimulating economic activity.

Despite these measures, the path to achieving the projected 0.9% growth is fraught with challenges. For the economy to meet this target, output must expand by approximately mid-1% in the second half of the year—an ambitious goal, given current conditions.

The labor market is expected to see a rise of 170,000 jobs this year, with growth in the services sector offsetting losses in construction and manufacturing. However, the shadow of high household debt looms large, posing a significant barrier to consumer spending, which is forecast to grow by 1.3% this year.

Inflation is anticipated to hover around the Bank of Korea’s 2% target, thanks to declining energy prices, but officials caution that geopolitical tensions and unpredictable weather could reignite price pressures. A current account surplus is now expected to reach $95 billion this year, up from earlier estimates due to lower import costs.

Looking ahead, the government aims to gain inclusion in MSCI Inc.’s developed markets index within President Lee Jae Myung’s term, with plans for a comprehensive roadmap to be unveiled by year-end. Additionally, a major 210 trillion won fiscal plan targeting the years 2026–2030 is set to advance initiatives in innovation, economic growth, and social welfare, with a significant focus on investments in artificial intelligence and biotechnology.

As South Korea navigates these turbulent economic waters, the potential ripple effects on global supply chains are significant. Stakeholders across industries are advised to keep a close watch on developments, as the outcomes could impact economies worldwide.

The urgency of these developments cannot be overstated—South Korea’s economic future hangs in the balance as the nation seeks to stabilize and grow amidst rising global challenges.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025