Top Stories

South Korea’s Inflation Drops to 1.7%, BOK Poised for Rate Cuts

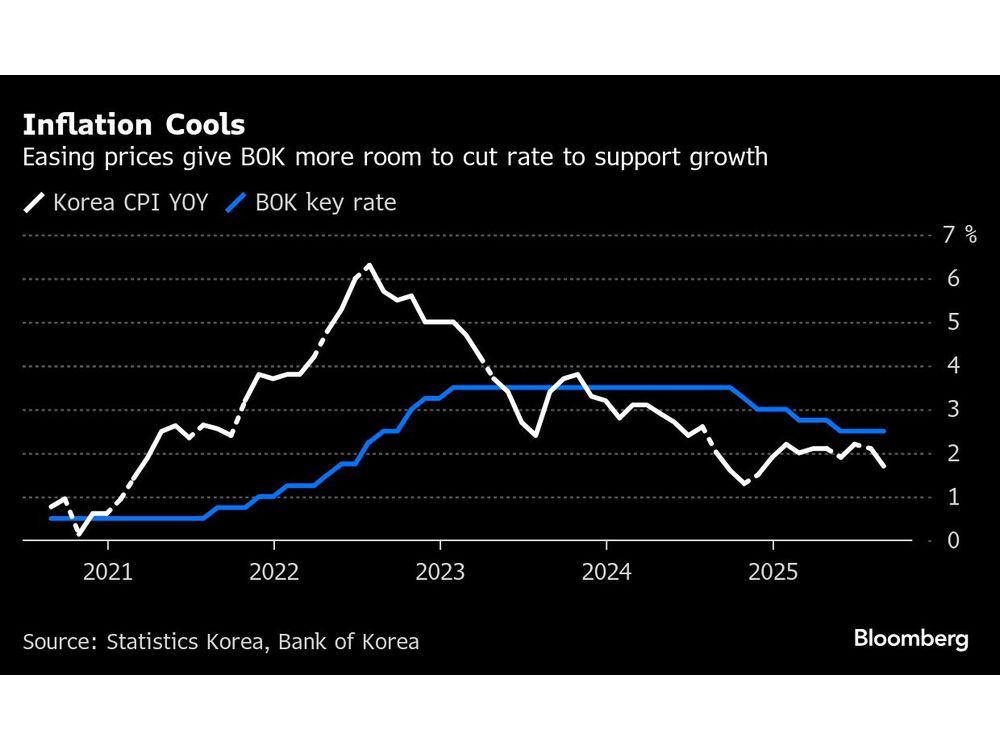

URGENT UPDATE: South Korea’s consumer inflation has just cooled to 1.7%, the slowest pace this year, paving the way for the Bank of Korea (BOK) to potentially resume its monetary easing cycle at the upcoming policy meeting on October 23, 2023. This significant drop from July’s 2.1% increase was reported earlier today by the Statistics Korea.

The easing inflation rate comes amid a notable reduction in communication costs, primarily due to SK Telecom‘s drastic cuts to mobile bills for over 20 million subscribers following a data breach. As this one-time effect fades, experts warn that overall price growth could rise again in September, underscoring the immediate economic implications for consumers and policymakers alike.

In a detailed report, the BOK noted that the core inflation measure, which excludes food and energy prices, rose by only 1.3% in August, down from 2% in July, marking the slowest growth in four years. This development is crucial as it signals a shift in the economic landscape, with expectations of renewed easing measures that could affect borrowing costs for millions.

Despite rising food prices, which surged by 4.9%, and increases in education and housing costs, the overall inflation decline offers a glimmer of hope for the BOK. Governor Rhee Chang Yong indicated that while the central bank raised its inflation forecasts to 2% for this year, there remains caution regarding upside risks as the economy navigates challenges from international trade measures.

Household debt pressures and a buoyant housing market continue to concern the BOK, which held the benchmark interest rate steady at 2.5% last month. Yet, with consumer confidence reaching a seven-year high and exports rising for three consecutive months, the central bank is closely monitoring these developments to support economic growth as conditions stabilize.

As the impact of tariffs imposed by the U.S. remains a pressing concern, analysts suggest that the BOK may be compelled to act swiftly to ease borrowing costs. Economists predict that the easing cycle could commence as soon as the housing market pressures subside, potentially providing relief to consumers facing increased living costs.

In summary, the latest inflation figures highlight the delicate balance facing South Korea’s economy and the BOK’s potential policy responses. With significant developments expected in the upcoming weeks, stakeholders are urged to stay informed on how these changes will affect daily life and economic stability in South Korea.

Stay tuned for more updates as this story develops, and share this with others to keep them informed on the latest economic trends impacting our lives.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025