Top Stories

Swiss National Bank to Maintain Zero Rates, Avoids Negative Step

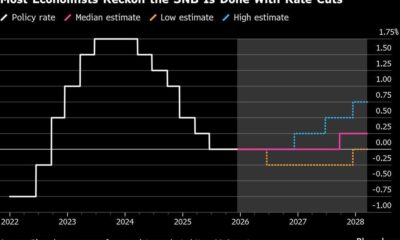

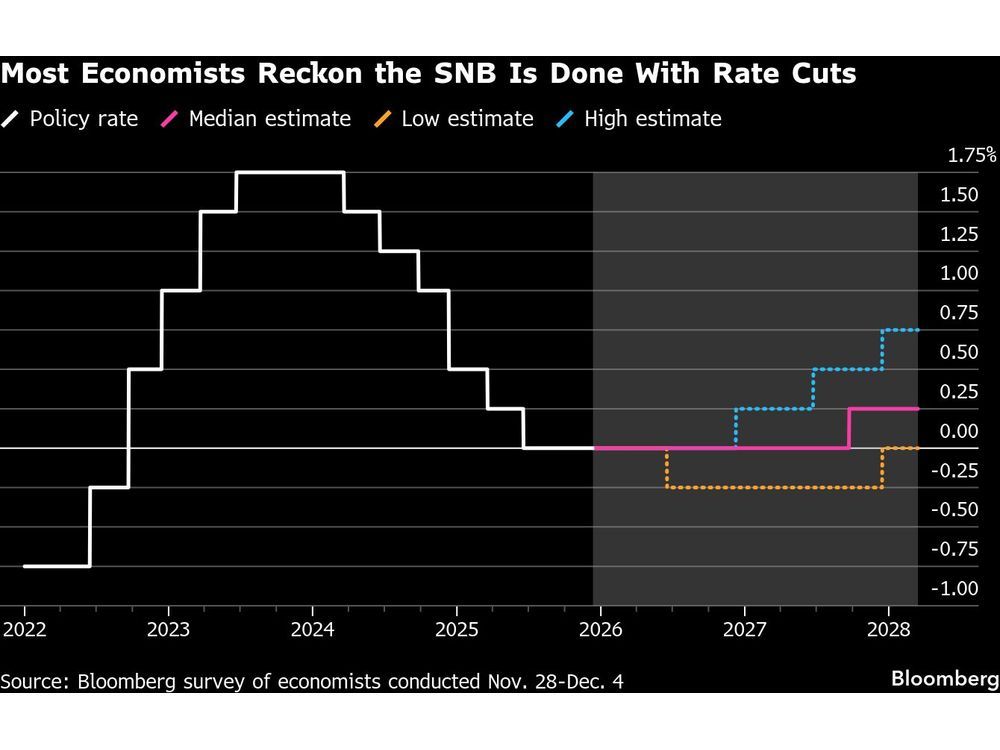

UPDATE: The Swiss National Bank (SNB) is poised to announce its decision to maintain interest rates at 0% during its upcoming meeting in December 2023, avoiding a return to negative rates amid rising inflation concerns.

As the franc surges and inflation forecasts dim, economists widely expect the SNB to stick to its current monetary policy. The decision reflects a cautious approach to protect Switzerland’s financial stability, especially in light of recent economic volatility.

Officials have been vocal about their commitment to prevent negative borrowing costs, stating that such a policy could harm bank profitability. Senior economist Nadia Gharbi from Pictet commented, “If they want to surprise markets, they will cut. But my baseline is that they stay on hold with a dovish tilt.”

This marks the second consecutive quarterly decision to keep rates at zero, signaling the SNB’s stringent criteria for any future rate cuts. The situation is compounded by potential shifts in US monetary policy, as the U.S. Federal Reserve may also move to cut rates, which could pressure the franc further.

Recent inflation readings have consistently underperformed expectations, with November’s figure hitting a six-month low of 0%. This unexpected downturn raises questions about the SNB’s earlier predictions of a rebound to 0.4% this quarter, potentially leading to a downward revision of the inflation outlook for 2026.

Economists are closely monitoring the SNB’s upcoming statements, particularly regarding the anticipated inflation forecast adjustments. Gero Jung, head of investment strategy at Banque Cantonale du Valais, indicated that significant changes could signal increased concern among policymakers regarding economic stability.

“If the annual expectation for 2026 goes to something like 0.2% or even closer to zero, that could be a signal that they are worried and could actually consider negative rates more seriously,” said Jung.

The SNB’s decision comes as the economy grapples with its first quarterly contraction in over two years, exacerbated by US tariffs. This economic backdrop has intensified scrutiny on the central bank’s next moves. Analysts suggest that if inflation remains stubbornly low, market speculation regarding potential rate cuts could grow stronger.

With the franc recently climbing to a decade high against the euro, the SNB faces mounting pressure to manage currency strength without resorting to negative rates. The anticipated decision to hold rates steady reflects a broader strategy to navigate these turbulent economic waters without compromising financial stability.

As the SNB prepares for its announcement, all eyes will be on how officials communicate their rationale and future policy direction. The decision holds critical implications not only for Switzerland’s economy but for global financial markets as well.

Stay tuned for live updates as the SNB’s decision unfolds. This is a developing story that could significantly impact economic landscapes across Europe and beyond.

-

Politics1 month ago

Politics1 month agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Top Stories1 week ago

Top Stories1 week agoHomemade Houseboat ‘Neverlanding’ Captivates Lake Huron Voyagers

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit