Top Stories

Trafigura Reports Profit Amid Rivals’ Struggles, Oil Market Shifts

UPDATE: Trafigura Group confirms strong performance in its oil sector despite widespread struggles among rivals. In an urgent interview in Singapore on Wednesday, Ben Luckock, head of oil at Trafigura, revealed that the company’s strategic investments are yielding substantial profits while competitors like Gunvor Group and Shell Plc face declining earnings.

Trafigura’s recent investments in refineries, including the Fos-sur-Mer refinery in France, and distribution assets through Greenergy, have “quickly made a material difference to our business performance and knowledge base,” Luckock stated. This news comes at a time when the oil industry grapples with unpredictable price volatility and a looming oversupply situation.

The oil market is currently seeing Brent crude prices hovering above $65 a barrel, bolstered by rising demand for fuels amid disruptions caused by the ongoing conflict in Ukraine. “In my opinion, fair value for oil is probably somewhere in the mid-$50s based on supply and demand fundamentals,” Luckock emphasized, noting that current prices reflect various risk factors, including geopolitical tensions and U.S. tariffs.

The trading community has faced a challenging nine months, with many firms struggling to adapt to policy-driven volatility. However, Trafigura’s new Asset Division, established to manage its extensive investments, is already making a significant impact. “The creation of the Asset Division is the single biggest change we’ve made in recent years. It has already had a very positive impact,” Luckock said.

Trafigura moves enough oil daily to supply France three times over and remains the world’s largest metals trader. The company recently reshuffled its crude and oil products teams, appointing Dan Woodbridge to lead crude operations and Tom Farrant to oversee global gasoline trading. Both have reportedly had a strong performance in the market.

As the oil industry gathers in Singapore, stakeholders are closely monitoring the market for signs of oversupply and the implications of rising production from OPEC+ countries. The ongoing conflict in Ukraine continues to impact production capabilities, intensifying the urgency for companies like Trafigura to maintain profitability.

With demand remaining robust and strategic investments paying off, Trafigura is positioned to navigate the current volatility while rivals struggle. The firm is under pressure to sustain its profitability, particularly to meet the payout obligations for senior executives who recently retired.

As the situation evolves, industry players and investors are advised to keep a close watch on market dynamics, particularly concerning geopolitical developments and their potential impact on oil prices. Trafigura’s proactive strategies may serve as a blueprint for resilience in a tumultuous market environment.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 weeks ago

Top Stories2 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

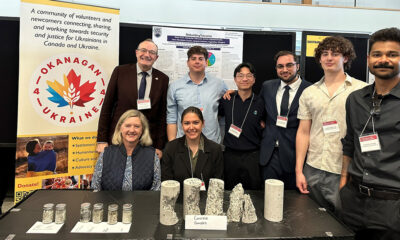

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics2 weeks ago

Politics2 weeks agoShutdown Reflects Democratic Struggles Amid Economic Concerns