Top Stories

Trump Tariffs Propel International Stocks to New Heights

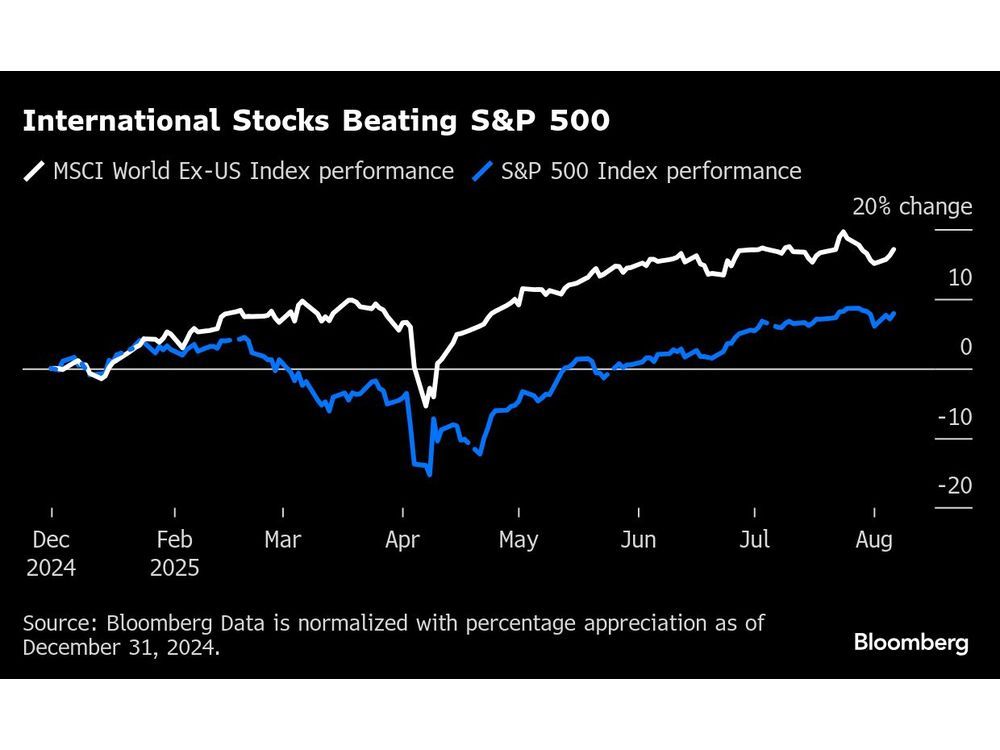

URGENT UPDATE: U.S. President Donald Trump’s tariffs are triggering a significant surge in international stock markets, marking a major shift in the investment landscape. New reports confirm that the MSCI World Index excluding the U.S. is outperforming the S&P 500 in 2025, with an impressive 18% surge compared to the S&P’s 7.8% gain.

This is the first time since 2022 that international equities are set to surpass U.S. stocks, and the first instance of this trend in a rising market since 2009. The shift is largely driven by fears that tariffs and associated trade uncertainties will significantly impact earnings growth for U.S. corporations.

In a striking reversal from previous years dominated by U.S. equities, key global markets are making impressive gains: Germany up 21%, Spain soaring 26%, and Mexico rising 18% this year. The UK and Canada also show positive trends, with gains of 11% and 12%, respectively.

Craig Basinger, Chief Strategist at Purpose Investments, notes that the valuation gap between U.S. and international markets is “historically wide.” He stated, “Sometimes the biggest gains come from the fixer-upper opportunities,” emphasizing the potential for significant returns as investors begin to pivot towards international equities.

The impact of these tariffs, set to take effect this month, is prompting a recalibration among investors, particularly as trading partners like Canada, Europe, and Japan implement reforms aimed at boosting domestic growth. “Rate of change matters in markets, and it would appear that international markets are becoming a bit more investor friendly,” Basinger added.

Moreover, a recent survey by BofA Securities revealed that 54% of fund managers predict international stocks will be the top-performing asset class over the next five years, a significant contrast to just 23% who favor U.S. equities.

Experts suggest that Trump’s tariffs may hit U.S. earnings harder than those in Europe or Japan, leading to a more optimistic outlook for international markets. David Groman, a director at Citi Research, stated, “Europe in particular is leading in value and momentum performance,” indicating that investors may have already priced in negative outcomes from tariffs, potentially leading to better-than-expected results.

However, caution remains among some strategists. Emily Roland and Matthew Miskin of Manulife John Hancock warn that historical trends suggest a U.S. recession could negatively affect global markets, stating, “Every other time in history if the U.S. sees a recession, it has brought the rest of the world down with it.”

The evolving landscape of international investments could lead to a substantial shift, with many analysts believing that the rotation away from U.S. stocks may be a protracted trend. Basinger emphasizes, “People just have too much U.S. right now,” adding urgency to the call for diversification.

As international stocks continue to climb, investors are closely monitoring upcoming corporate earnings reports and tariff developments for further guidance on market trajectories. The next few weeks may prove crucial as these dynamics unfold, reshaping investment strategies worldwide.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025