Top Stories

U.S. Stocks Plunge Amid AI Bubble Fears and Rate Concerns

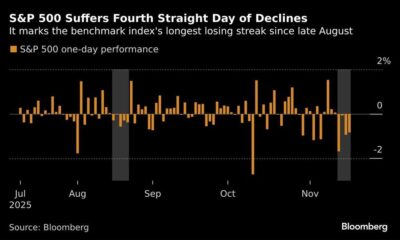

URGENT UPDATE: U.S. stock markets are in turmoil, with major indexes erasing significant early gains as investors grapple with fears surrounding artificial intelligence (AI) and interest rates. Just hours after a promising start, the S&P 500 plummeted 1.6%, while the Dow Jones Industrial Average fell by 386 points (0.8%) and the Nasdaq Composite sank 2.2% on October 12, 2023.

The market opened with an impressive 1.9% surge, but this momentum quickly dissipated, reflecting ongoing volatility and uncertainty. Canadian markets were not spared, as the S&P/TSX composite index dropped over 370 points, largely due to losses in the basic materials sector.

The sell-off was driven by renewed concerns over the sustainability of AI stocks, particularly Nvidia, which initially reported strong profits but triggered fears of an impending bubble. Nvidia’s stock rose by 5% early in the day, only to reverse course, closing down 3.2%. Analysts at UBS expressed skepticism, stating, “It is very hard to see how this stock does not keep moving higher from here,” yet investors are worried that the flood of investment into AI technology may not yield the promised returns.

Adding to the market’s woes, Bitcoin fell below $87,000, dropping significantly from nearly $125,000 just last month. The cryptocurrency sector faced significant losses, with shares of Robinhood Markets and Coinbase Global down by 10.1% and 7.4%, respectively.

Market strategist Carol Schleif from BMO Private Wealth noted the unusual volatility, stating, “The whipsaw today is more unusual just because of the breadth… we haven’t seen those moves in a long time.” This sharp turnaround raises questions about market stability, especially given the record high levels seen in previous months.

Investors are also closely watching the U.S. Federal Reserve’s next moves. A mixed jobs report released earlier provided some relief. Although hiring was stronger than expected in September, the slight uptick in the unemployment rate complicates the Fed’s decisions on interest rates. Currently, traders assign a 40% probability to a potential rate cut at the Fed’s next meeting in December, an increase from 30% the day before.

In a rare bright spot, retail giant Walmart reported a strong quarter, seeing its shares rally by 6.5% amid robust sales, attracting budget-conscious consumers. However, this positivity was not enough to counteract losses in the tech sector.

As markets continue to react to these developments, investors are left pondering when, or if, stability will return. The volatility witnessed today mirrors previous tumultuous periods, reminding traders of the fragility of current market conditions.

WHAT’S NEXT: Investors should monitor upcoming economic indicators and Federal Reserve announcements closely, as these will play a critical role in shaping market sentiments in the coming weeks. With uncertainty looming, the stakes for the market remain high.

-

Politics2 weeks ago

Politics2 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Lifestyle2 months ago

Lifestyle2 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations