Top Stories

UK Household Debt Plummets to 23-Year Low, Sparks Consumer Hope

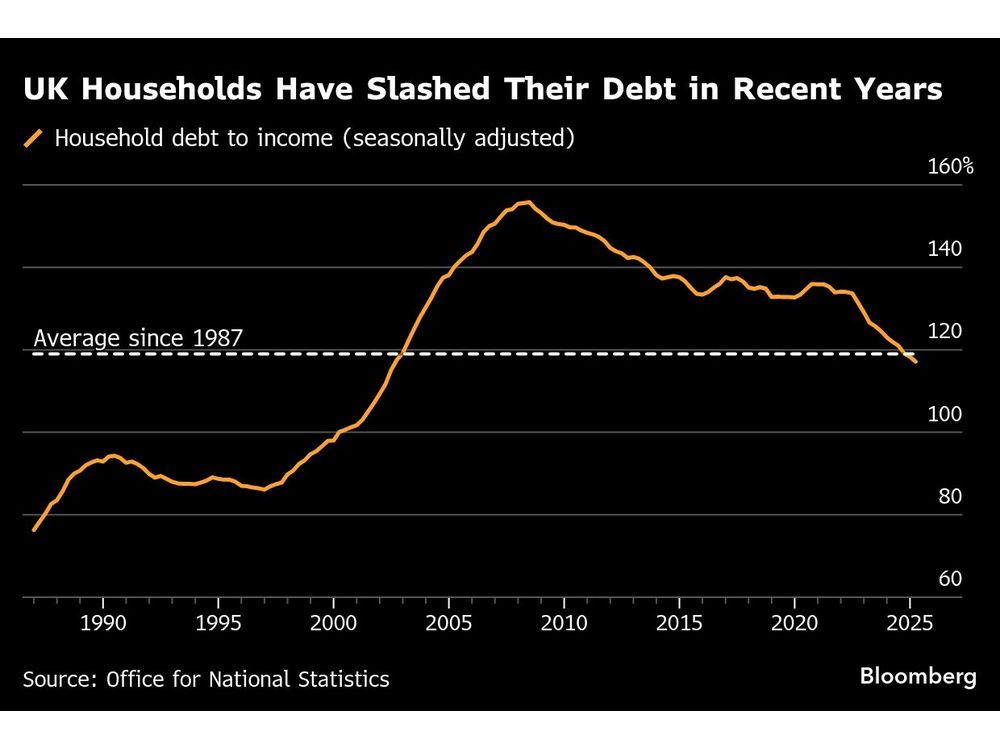

UPDATE: UK household debt has dropped to its lowest level in over two decades, raising hopes for a consumer spending revival. According to the Office for National Statistics, debt as a share of household income has plummeted to 117.1% in the second quarter of 2023, a staggering decline of almost 40 percentage points from its peak in 2008.

This significant reduction in debt comes after a prolonged period of spending restraint, which has heavily impacted the British economy. The crucial question now is whether consumers will feel confident enough to start spending again as the nation approaches a pivotal budget announcement from Chancellor Rachel Reeves on November 26.

Consumer confidence is critical, as households account for approximately 60% of the UK’s gross domestic product (GDP). Recent comments from economists indicate that while household balance sheets are in good shape, the lingering impact of previous economic crises, including the pandemic and energy-price shocks, has made consumers hesitant to spend.

James Smith, a developed market economist at ING, noted, “The consumer is an upside risk to growth… the problem at the moment is confidence is still relatively low.” The savings ratio remains high, suggesting that while consumers have the means to spend, their willingness to do so is still uncertain.

The latest data reveals UK household consumption has only increased by 0.7% since the end of 2019, starkly contrasting with a 3.9% rise in the eurozone and a robust 16.4% surge in the United States. This caution has left the UK economy just 5% larger than it was before the pandemic, compared to 13% growth in the US and substantial increases in other developed economies.

Bumper wage growth has seen household disposable incomes rise by almost 33% since 2019, outpacing increases in mortgage debt and consumer credit. However, many consumers remain focused on saving rather than spending, which could hinder overall economic growth.

Looking ahead, estimates from PwC suggest that growth could reach 1.6% next year if households decide to tap into their savings. Martin Beck, chief economist at WPI Strategy, highlighted that while prices and wages are rising, the real value of debt is being eroded, yet borrowing demand remains weak.

The Bank of England anticipates a recovery in household consumption in the coming years, but officials stress the importance of maintaining a tight monetary policy to bolster consumer confidence. Rate-setter Catherine Mann emphasized the need for visible signs of inflation control to encourage spending.

As the UK braces for the upcoming budget, all eyes are on Chancellor Reeves and her potential strategies to boost consumer confidence and economic growth. The nation awaits to see if these developments will finally lead to a revival in consumer spending that could reinvigorate the economy.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025