Top Stories

UK Households Hoard Cash Amid Christmas Spending Fears

UPDATE: UK households are tightening their belts as fears of financial insecurity mount ahead of Christmas. Recent warnings from former Bank of England rate-setter Michael Saunders reveal that Britons are hoarding cash instead of spending, igniting concerns for the crucial festive trading season.

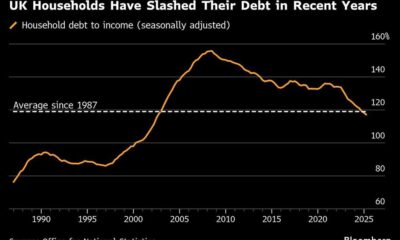

As inflation soared to a staggering 11% in late 2022 and mortgage rates increased, many families are saving more than ever, driven by a lingering sense of uncertainty. A new report from Oxford Economics indicates that saving rates have surged 2.5 percentage points higher than the long-run average, with consumers feeling they lack sufficient funds for emergencies.

Latest data shows that consumer spending, which constitutes about 60% of the UK economy, has stagnated for the past three years. This stagnation comes at a critical time, as the economy faces its first quarterly contraction in two years. In October, GDP shrank for a second consecutive month, with retail sales plummeting as shoppers hold back.

Authorities are concerned about the impact of these trends on the holiday season, a key revenue period for retailers. Despite having more savings than before the pandemic, Saunders highlights that consumers remain cautious, particularly among the 25-55 age group, renters, and those with limited savings.

“Even though the median level of liquid assets is higher now than pre-pandemic, the share of households reporting insufficient emergency savings has risen sharply,” said Saunders. The Bank of England acknowledges this caution, signaling a potential interest rate cut on December 18 to 3.75% to stimulate spending.

A recent survey by consulting firm RSM revealed that if given a one-off windfall of £5,000 ($6,673.5), nearly 57% would save it or pay down debt, while only 8% plan to spend it on Christmas gifts. This sentiment underscores the prevailing anxiety affecting consumer behavior this holiday season.

The findings resonate with historical patterns following major economic shocks, such as the Great Depression and the inflation crisis of the 1970s. A troubling trend emerges, as financial insecurity continues to impact many households across the UK.

As the holiday season approaches, the focus will remain on consumer behavior and spending patterns. With the economy teetering on the brink of further contraction, the urgency for a revival in household spending is greater than ever. Keeping an eye on government responses and potential financial measures will be crucial in the days ahead.

-

Politics1 month ago

Politics1 month agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Technology4 months ago

Technology4 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Top Stories2 weeks ago

Top Stories2 weeks agoHomemade Houseboat ‘Neverlanding’ Captivates Lake Huron Voyagers

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit