Top Stories

Urgent Alert: 76% of Americans Use Buy Now Pay Later, Half Miss Payments

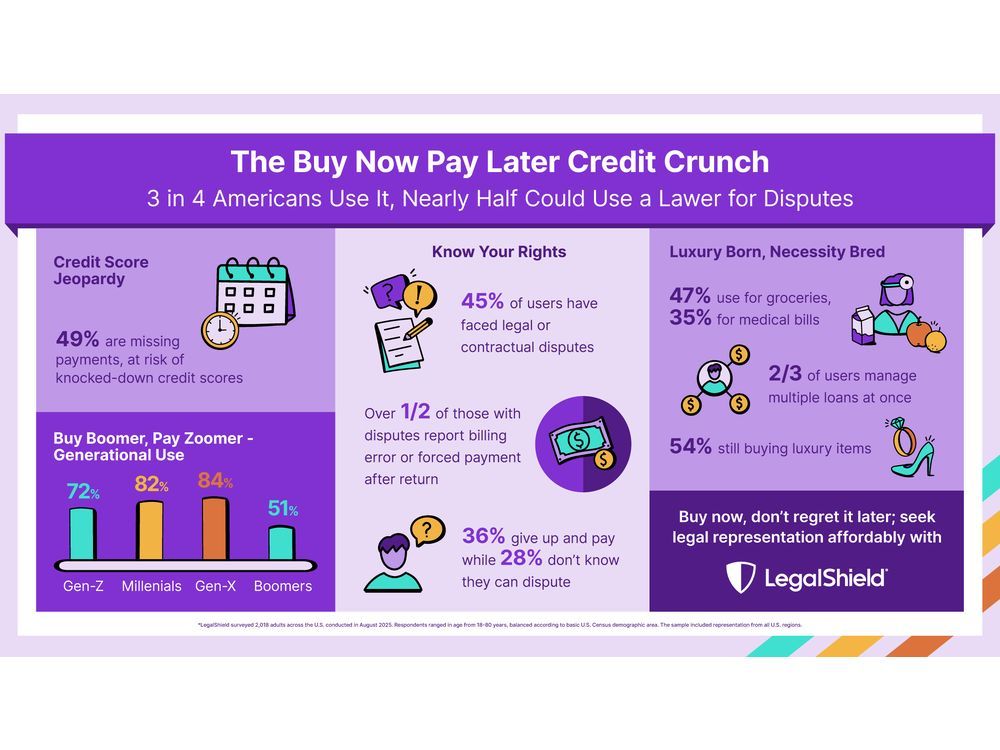

UPDATE: A startling new study from LegalShield reveals that a staggering 76% of Americans now rely on Buy Now, Pay Later (BNPL) services, with 49% admitting to missed payments. This urgent report underscores a significant shift in consumer behavior, as BNPL transitions from a luxury to a necessity, with many Americans using it for essential expenses like groceries and medical bills.

The survey, conducted among 2,018 Americans in August 2025, shows that nearly 67% of BNPL users juggle multiple loans, often leading to financial strain and legal disputes. Warren Schlichting, CEO of LegalShield, warns, “Our survey finds nearly half of BNPL users are facing potential legal disputes over BNPL purchases, and most don’t even know they have rights.”

This alarming trend is affecting all demographics, with 47% of users relying on BNPL for groceries and 35% for medical bills. While luxury purchases remain popular—54% of respondents reported buying items like designer handbags—many are unaware of the impending changes to their credit scores. 38% of Americans do not know that FICO will soon include BNPL data in its credit scoring model, a move that could further hinder the financial stability of those who have missed payments.

As household debt delinquency reached 4.4% in Q2, the highest level since Q1 2020, consumers are feeling increasingly overwhelmed by their financial commitments. The survey indicates that 45% of BNPL users have faced legal disputes, with 62%60% forced to pay after returning items. Many individuals feel powerless in these situations, with 36% opting to pay incorrect charges and 28% unaware of their legal rights to dispute such claims.

The study highlights concerning patterns across generations. Among Gen Z, 72% use BNPL, with 87% skipping terms reading and 76% feeling unprepared for disputes. Millennials follow closely, with 82% relying on BNPL and 71% managing multiple loans. Gen X leads in usage, with 84% participating and 62% missing payments, while Baby Boomers represent 51% usage but struggle with disputes.

As the landscape of consumer credit evolves, this report serves as a critical reminder to stay informed and proactive. LegalShield’s findings emphasize the need for legal guidance to navigate the complexities of BNPL arrangements. “BNPL has evolved from a simple payment option into a complex financial tool that can become overwhelming for families without proper understanding and legal guidance,” cautions Rebecca A. Carter, a LegalShield provider lawyer.

With millions of Americans caught in the BNPL trap, the urgency for education and advocacy surrounding consumer rights has never been greater. As this situation develops, consumers are urged to remain vigilant and seek legal assistance if they encounter issues with their BNPL agreements.

Stay tuned for further updates on this pressing financial issue that impacts nearly every American.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 weeks ago

Top Stories2 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics2 weeks ago

Politics2 weeks agoShutdown Reflects Democratic Struggles Amid Economic Concerns