Top Stories

Urgent Insurance Crisis: Customer Struggles to Pay Bill Amid Service Failures

UPDATE: A Winnipeg resident, Joanne Seiff, is experiencing an escalating crisis with her insurance company, struggling for over a week to pay her bill. The situation, compounded by ongoing service failures and an inability to reach customer service, has sparked urgent conversations about the pitfalls of automated systems in customer service.

Seiff’s frustration peaked after multiple failed attempts to contact her insurance provider. Each call ended with the same automated message: “All circuits are busy at this time. Please hang up and call again later.” After a full week of being locked out of her online account and no response from phone support, she turned to media relations for help, pleading, “Please let me pay my bill so I don’t have to write about this incredibly frustrating situation.”

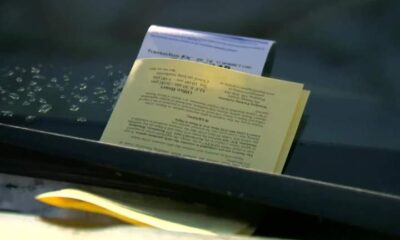

The issue is not just personal; it reflects a broader trend impacting consumers nationwide. As Canada Post workers strike, delays in mail services are exacerbating the problem, leaving many unable to meet payment deadlines. Seiff notes that the reliance on traditional mail, even outside of strikes, often leads to weeks of waiting for cheques to clear.

In an age where online payment apps are touted for efficiency, Seiff’s household has opted for physical bills to ensure visibility and accountability. She argues that these systems, while designed to streamline processes, can inadvertently complicate them, especially when couples share financial responsibilities.

Despite finally receiving a response from her insurance provider, the solution was less than satisfactory. After navigating a convoluted security protocol, she was given the contact information for a representative, but subsequent calls have only reached voicemail.

This experience raises critical questions about customer service in a digital era. Seiff points out that while technology aims to enhance efficiency, it often removes the personal touch necessary for effective problem-solving.

Recent research indicates that social interactions, even brief ones, can significantly improve mental health and community connections. Yet, as companies increasingly shift towards automated systems and artificial intelligence, the opportunities for meaningful interactions diminish.

Seiff’s experiences reflect a growing dissatisfaction among consumers who feel that their needs are overlooked in favor of cost-cutting measures. She argues, “Making it this difficult to pay one’s life insurance premium means something has gone seriously wrong.”

As automation continues to rise, experts warn that the lack of human interaction could lead to greater customer dissatisfaction and potential loss of business. Seiff’s struggle highlights the urgent need for companies to balance efficiency with empathy in customer service.

What’s next? Consumers are urged to share their experiences to push for better service standards and accountability in the industry. As the conversation continues, Seiff’s story serves as a reminder of the importance of human connection in an increasingly automated world.

This developing story underscores the urgent need for companies to reevaluate their customer service models and prioritize genuine interactions that foster trust and satisfaction.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025