Top Stories

Urgent: Orsted Moves Forward with $9.4 Billion Share Sale Amid Crisis

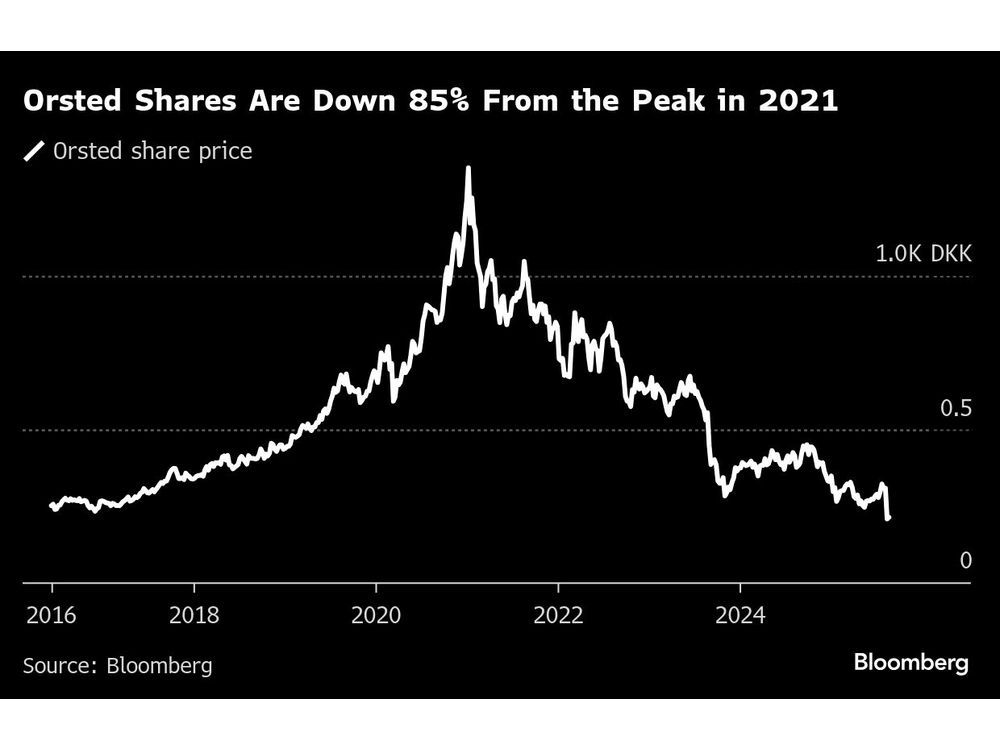

UPDATE: Orsted A/S is pressing forward with a monumental share sale, aiming to raise $9.4 billion in a desperate bid to mitigate a profound crisis. The urgency follows a stop-work order issued by the Trump administration for the nearly completed Revolution Wind project, which has already cost an estimated $4 billion to develop.

The share sale, earmarked to raise 60 billion Danish kroner, marks the largest capital raise in the European energy sector in over a decade. This decision comes as Orsted faces mounting pressure following a recent credit rating downgrade to the lowest investment grade, alarming investors and stakeholders alike.

The halt on Revolution Wind, announced on August 11, is the latest setback in Orsted’s struggle to replicate its successful European operations in the U.S. market. The company has been beset by various challenges, including supply chain issues and the cancellation of two major projects, which have necessitated a series of writedowns and executive changes.

In light of the recent developments, investors are keenly watching to see if Orsted can negotiate a resolution with the government. The uncertainty surrounding the project could significantly impact investor interest in the rights issue. As Orsted stated, “The planned rights issue has been sized to provide the required strengthening of Orsted’s capital structure to execute its business plan.”

With the political landscape shifting rapidly, Connecticut and Rhode Island governors are actively seeking to amend the stop-work order. Connecticut Governor Ned Lamont expressed his dismay, stating, “This political move by the Trump administration will drive up the cost of electricity bills and contradicts everything the administration has told us.”

The potential fallout from these developments could be severe. Analysts, including Jacob Pedersen from Sydbank A/S, warn that Orsted may face a double-digit billion write-down if these issues persist.

In an alarming trend, the Trump administration has historically targeted offshore wind projects, including halting construction on Equinor ASA’s Empire Wind earlier this year. This latest intervention signifies a troubling escalation for renewable energy initiatives in the U.S.

As the situation unfolds, Orsted is exploring all avenues to expedite discussions with permitting agencies, including possible legal action. The company’s commitment to navigating this crisis could have lasting implications not just for its financial health but also for the future of offshore wind energy in America.

With total investment needs across its two U.S. projects projected to reach approximately DKK 100 billion, the stakes have never been higher. Orsted’s ability to secure necessary funding now hinges on the success of this urgent share sale, making it a pivotal moment for the company.

Stay tuned as we monitor this developing story and its implications for the energy sector and investors worldwide.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025